Slow Motion Trainwreck

The precarious state of the US labor market.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

Last week I discussed how the Federal Reserve (Fed) doesn’t have as much control over interest rates as their given credit for. Ultimately, even shorter-term interest rates are determined by the market. The market is using clues from economic data about employment, inflation, and the economy to price interest rates.

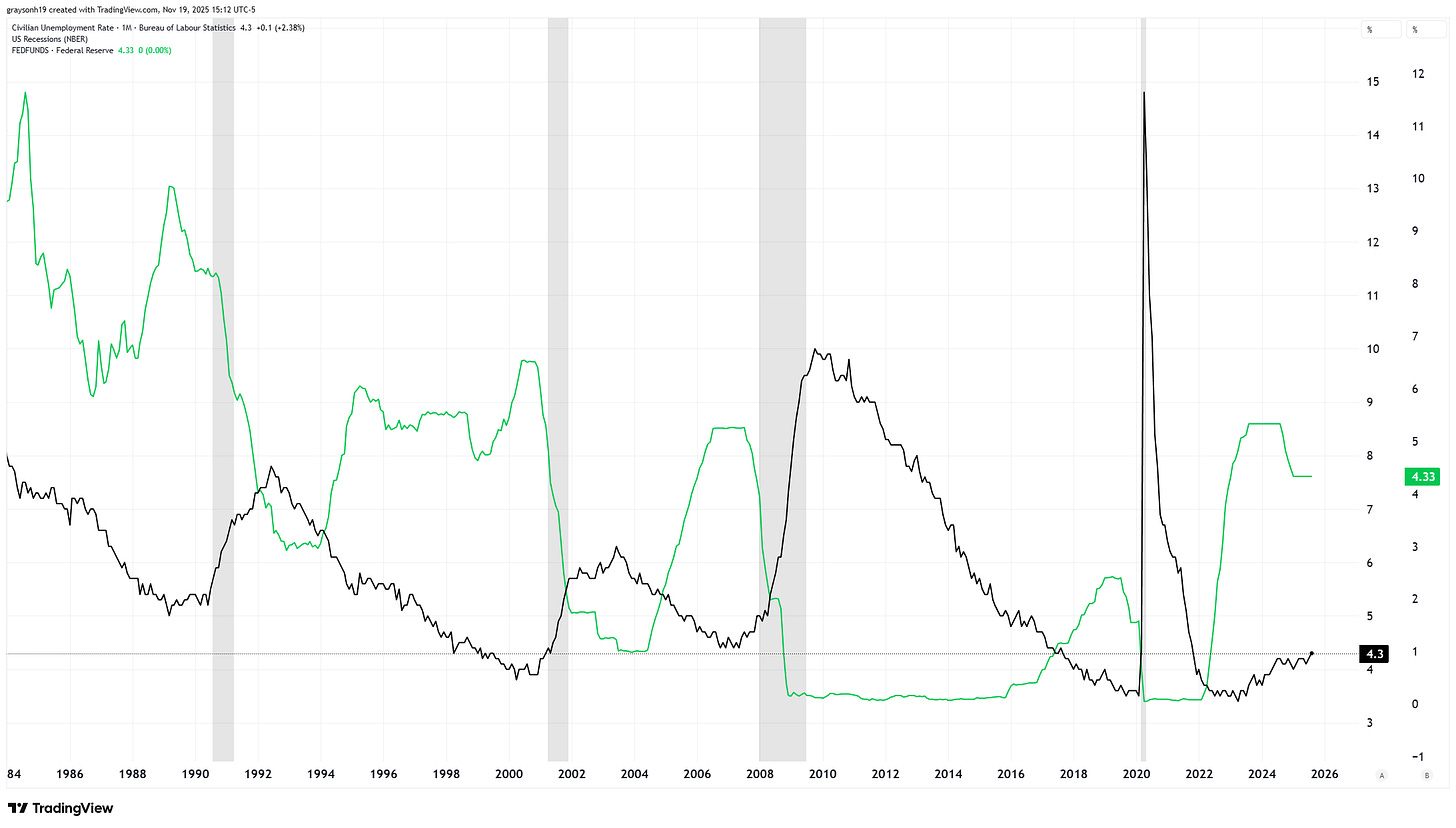

Regardless, the Fed continues to pretend to operate on its “dual mandate” to maintain stable prices and employment. Inflation has been the boogie man for the last few years, not the employment picture. The unemployment rate since 2022 has been at historically low levels and is currently at 4.3%. Readers will know that I have been skeptical about the health of the economy and financial markets for a while, but nothing matters until the unemployment rate picks up.

Historically, there has been a severe correlation between the unemployment rate and interest rates. Currently, interest rates are starting to come down from their peak, which means that the growth/inflation is subsiding. No one knows how severe the slowdown will be, but historically, this has ended with a recession and spikes in unemployment.

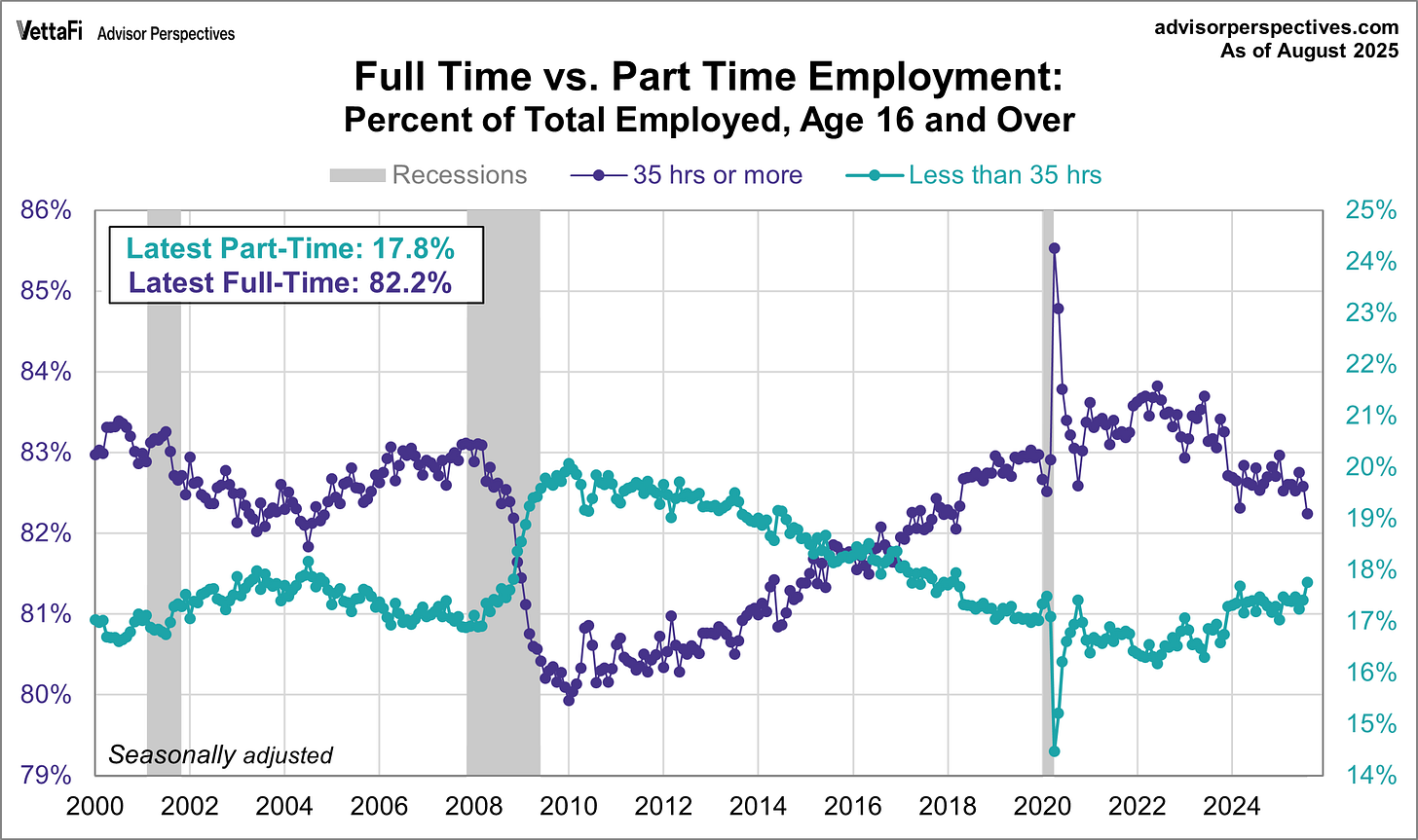

A healthy economy is built upon full-time jobs. As people spend less and the economy weakens, interest rates come down. During this time, employers’ profit margins tighten, causing many to cut hours and lay off workers. Typically, people will get hours cut and pick up part-time jobs before the broad unemployment rate increases. While the broad unemployment rate is only rising slightly, full-time employment is being replaced with part-time employment. This is obviously not a good sign for the health of the economy.

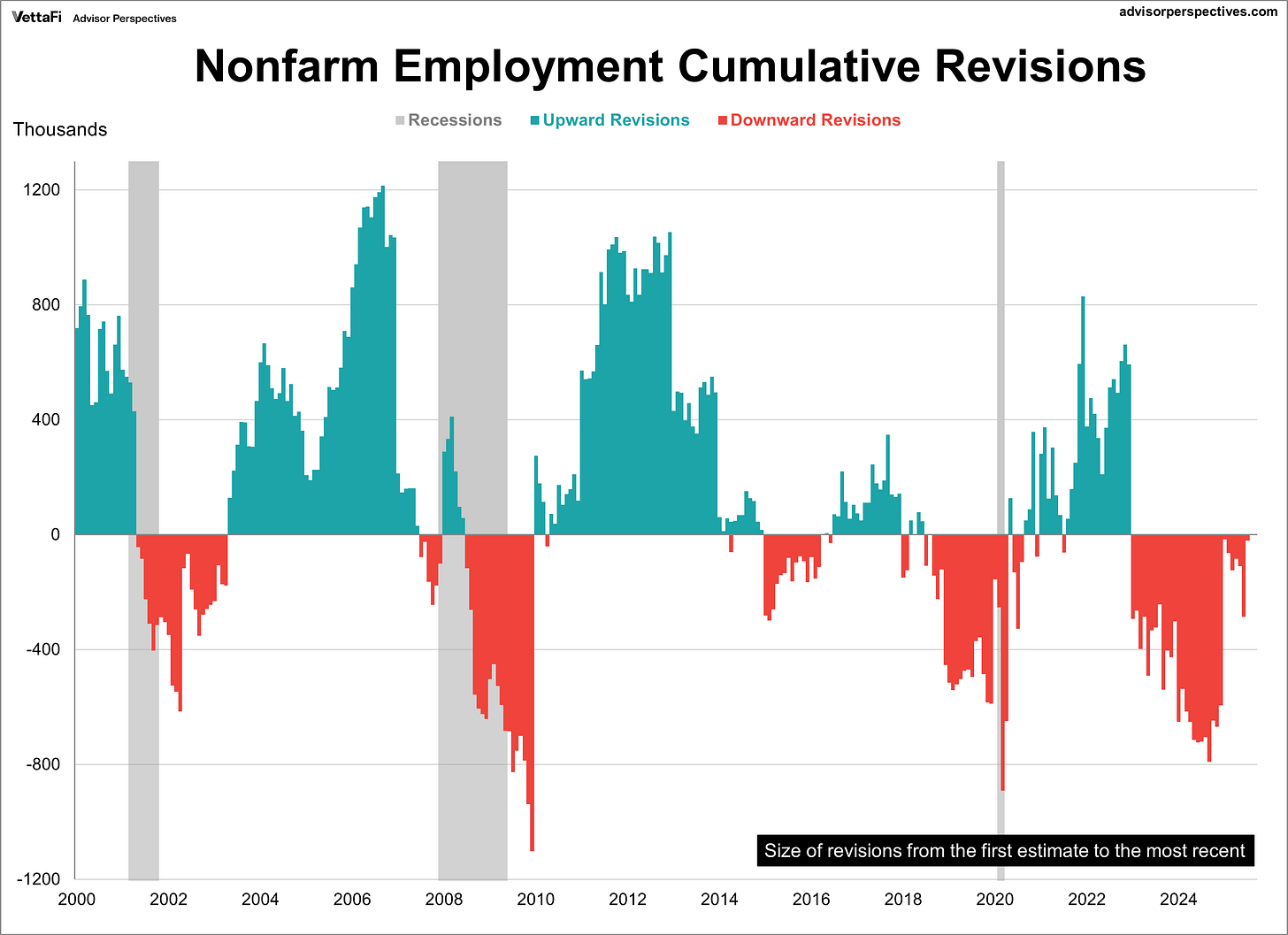

Many people have become skeptical of the official record-keeping of the government. Some argue political motivations for fudging the numbers, others argue outdated data collection methods. Either way, the data must be revised in the months following the official data releases, often with huge variations and inaccuracies. From Sep 2024 to Sep 2025, nearly 1 million created jobs were revised away. The real employment picture was far worse than the headline numbers have suggested. You can see visually that this typically leads or coincides with a recession.

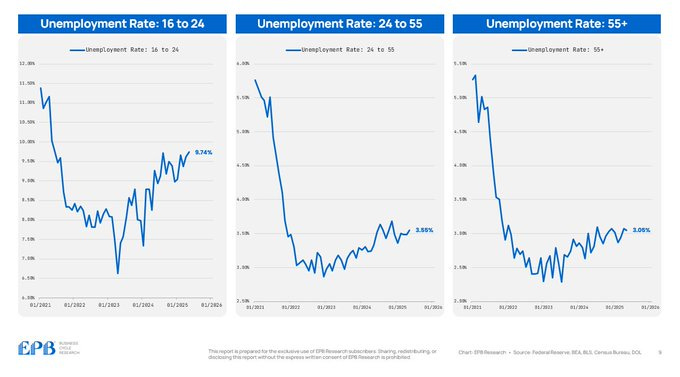

Another leading sign of weakness is breaking down employment by age group. The unemployment rate for young folks is nearly 10% and rising faster than the older age cohorts. While there may be complicating factors, this implies that young folks are having a hard time picking up jobs. The first thing companies do before laying off is freeze new hiring.

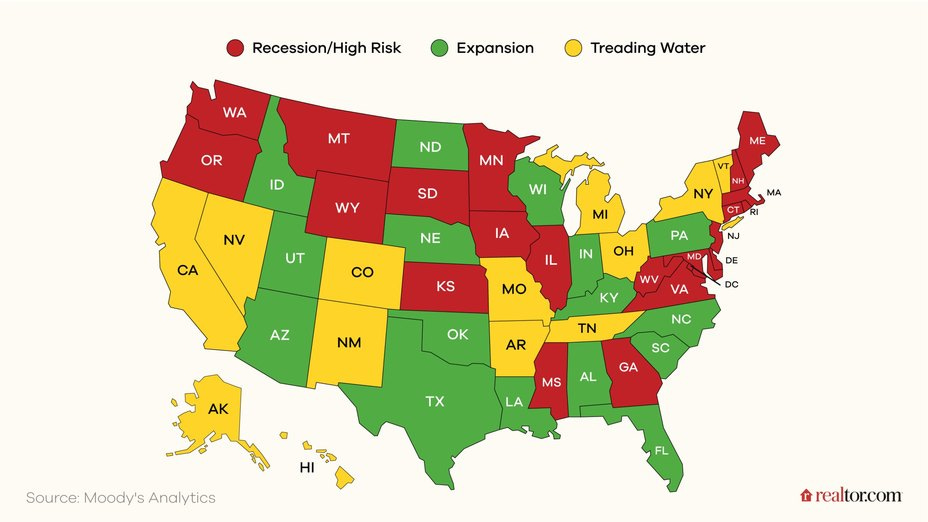

Divergence between sectors and regions exists. Of course, healthcare and data center buildout are propping up economic activity and employment. A Moody’s report suggests that 22 states are in or near recession. If this is the case, are we more likely to drop further or accelerate out of these conditions without loss of employment?

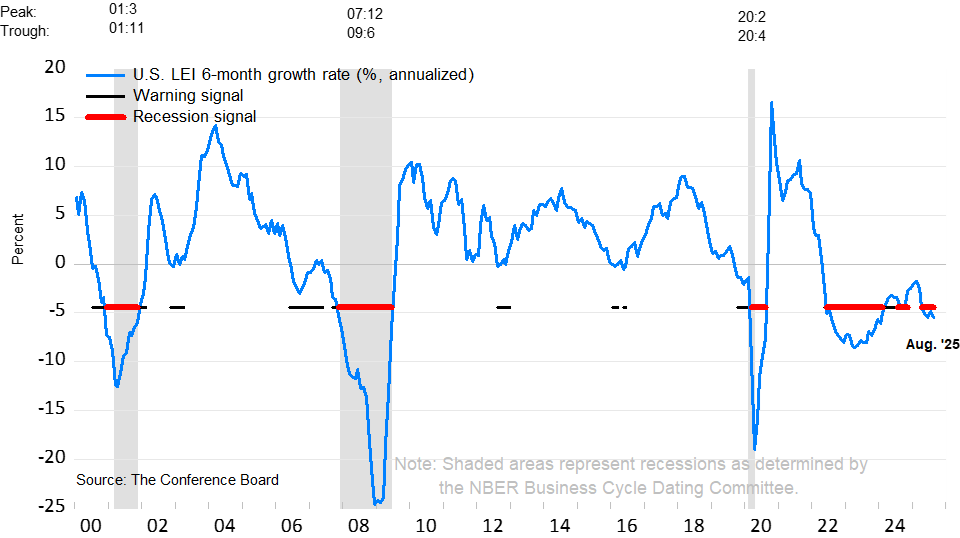

To me, it looks like a continuing slowdown is likely. The Conference Board publishes an index called Leading Economic Indicators (LEI). This is a basket of data that tends to lead economic slowdowns, rather than lag or coincide. Some of the data are credit conditions, stocks, interest rate spreads, consumer expectations, new business orders, building permits, weekly hours, initial jobless claims, and manufacturing conditions. The LEI has been negative since 2022, implying recession-like symptoms. This is obviously somewhat wrong, since no official recession has occurred yet. However, GDP did have two consecutive quarters of negative growth in 2022, which some consider a recession. Since the unemployment rate didn’t change, there was no official recession. After a brief recovery over the recession signal, the index has again turned lower as of the August data point.

What does this all mean? First off, things will likely get worse before they get better, meaning more unemployment is likely in the future. This may mean cutting spending and increasing savings in case of job cuts or waiting to purchase a new home if possible, since prices should come down.

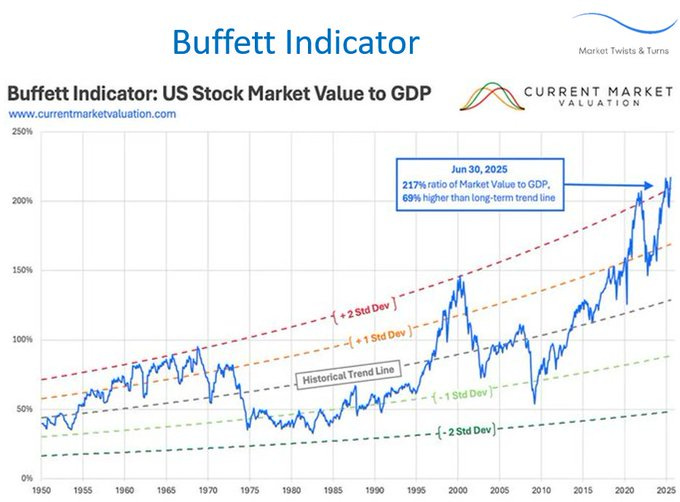

For markets, it means extra danger in an overvalued stock market. Alongside the Shiller P/E ratio that suggests overvaluation, there is the Buffet Indicator. This shows the stock market value relative to the underlying US GDP. This effectively ties the price of companies to the real economic value being produced. Currently, the market is at 2 standard deviations above the historical trend line, implying extreme valuations only seen during the 1960s and 2000 bubble peaks.

https://x.com/BraVoCycles/status/1983210970047537436?s=20

Right now, the economy and stock market are not connected. This will remain the case until they are. I say this because passive index flows are a major reason that valuations are being elevated. From 401k money plowing into the S&P 500 every month without a thought, or conventional wisdom to buy and hold, this money is tied to income. When the unemployment rate increases, there will mathematically be fewer passive flows. In addition, people will likely be scared and change their investing habits out of fear.

Stocks will go down, and may go down in a hurry in this event, but that doesn’t mean tomorrow. We are close to a recession, as the unemployment and leading indicators are suggesting, but the stock market can continue to be irrational longer than you can remain solvent, like the famous quote says. I would not be surprised to see more highs following the current market correction. But it is a precarious time to be invested in the market. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

The shift from full time to part time employment is one of the most undereported trends right now. Companies are clearly adjusting their workforces before making harder decisions about layoffs. The young worker unemployment spike is particulary concerning since it suggests hiring freezes are already widespread. Your point about passive flows from 401ks propping up valuations makes a lot of sense, especialy when you consider how quicky sentiment can shift once job losses accelerate.

It's really hard to see how this all plays out. Some are calling for an outright stock market crash and recession and even deflation. Others are talking about the oddly similar charts with the 70s stagflation period. The enormous Federal debt adds another layer of concern, as our hands are somewhat tied to how we cope with economic crisis. Deflation MAY be the best outcome as painful as it is as it tends to reset prices to workable levels (like in housing and healthcare). That would break the back in the Federal debt though, forcing some kind of deleveraging or default (as inflation allows the government to kick that can down the road),or at least that's what I've been gathering of late. Interesting times!