Lagging Behind

Who's really in charge of interest rates?

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

It is becoming common knowledge that the Federal Reserve (Fed) controls interest rates. Politicians, consumers, businesses, and real estate investors alike are all eagerly awaiting the next interest rate decision. President Trump is even trying to manipulate Fed Chairman Jerome Powell to lower interest rates through various threats and games. During previous crises like 2000, 2008, and 2020, the Fed aggressively cut interest rates in an effort to stimulate bank lending and revive the economy in a time of recession and fear. What if I told you the Fed doesn’t actually control interest rates, would you believe me?

The Fed controls the short-term interest rate paid to banks, known as the Fed Funds rate. For longer-term bonds like the 10-year Treasury bond, other market factors play a role. These market factors are economic growth (GDP) and inflation (CPI). The 2-year treasury bond is somewhere in the middle, with rate cut expectations and short-term economic outlook priced in.

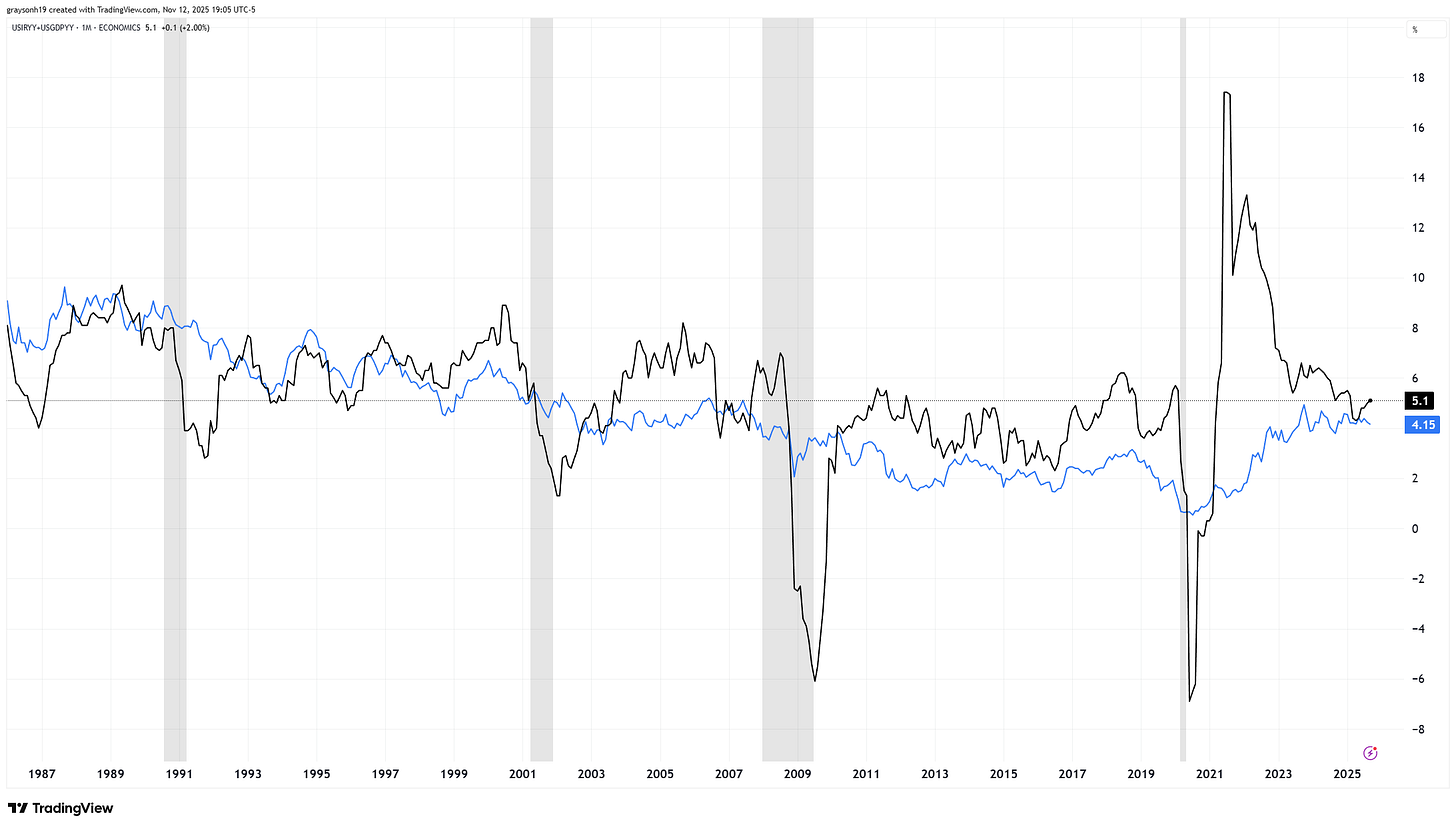

Mainstream economics suggests that the Fed adjusts interest rates, which in turn affect borrowing costs, ultimately impacting the real economy. However, if you plot the 2-year treasury yield vs the fed funds rate, you can see that the Fed is consistently lagging the 2-year yield. Whether by 1month or 6months, market expectations and demand for 2-year bonds are ahead of Fed actions.

The Fed talks a big game, but it merely follows market expectations for near-term economic conditions expressed in the bond market. If the Fed drives interest rates, the order of operations should be opposite. They must keep their fed funds rate in line with market interest rates, or things can go haywire in lending markets. You may argue that the Fed’s forward guidance at press conferences tells the market what to expect, thus the Fed is still the driver. I disagree, as guidance is based on the very economic data that the market is also looking at, whether it be CPI prints, jobs reports, or liquidity conditions. The bond market often reacts to these data prints to a greater extent than Fed guidance. Further, there are times when the 2-year yield moves well in advance of any hawkish transition from the Fed (i.e, 2022).

If the doesn’t actually control interest rates, what then is the purpose of the Fed? First, if we replaced the Fed interest rate decisions with market rates (or the 2-yr yield), then there wouldn’t be any changes. This is only to maintain credibility in the eyes of the public. The Fed’s real job is to bail out the banking industry. In Twin Chains, I discuss how the creation of the Fed was a ploy to ensure an inseparable bond between big banks and the Federal Government. That brings us to the second point. Without a tie to the Gold Standard, the Fed’s second job is to maintain adequate liquidity and funding of US federal debt. This is clearly seen by the debt monetization and purchase of treasuries by the Federal Reserve.

While radical, the Fed shouldn’t have credibility in controlling the economy, in my opinion. While this argument may seem like the Fed is powerless, it facilitates moral hazard through bailouts and drives distortions with excess liquidity. This can exacerbate government waste, build up malinvestment, and decrease growth over time. It can even decrease interest rates on the margin, but overall economic growth and inflation are the real drivers of bond yields.

The sum of US GDP and CPI in black is correlated strongly with the 10-year bond yield (blue) over time. This often breaks down for short periods during recessions and in the immediate recovery periods. Overall, the real economy is in control of bond yields, not the Fed.

Many investors await every word from the Fed press conferences and try to predict the next Fed interest rate moves. Instead, they can simply look at the 2-year bond yield to see where rates are going. If everyone realized the true purpose of the Fed, we might be a bit more pessimistic about our government. The real trick is to understand the real drivers of the economy, such as where employment is headed, where there is malinvestment, and where there is opportunity. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView