🔋That's So Metal

Renewables have a significantly higher resource requirement than current forms of electricity production, corroborating lower energy return on energy invested metrics.

If you found this article interesting, click the like button for me! I would greatly appreciate it :)

Last week I discussed the energy return on energy invested (EROEI or EROI) and its importance in determining whether a energy/fuel source is truly feasible in today’s high energy demand society. We take our excess energy and build up various institutions and endeavors beyond the mere needs of survival. Related to EROEI is naturally how much effort it takes to prepare the materials needed for a certain process. The raw material extraction process is an energy intense one which contributes to the wide variations in EROEI of different energy sources.

I’ve discussed previously the need for lithium, graphite, and copper for batteries and other energy transition infrastructure and how the expected demand looks to exceed current levels of supply. We must project out the demand as well as new production coming online to get a true understanding of what the price may do.

Demand is elastic, meaning it fluctuates high and low quicker than supply and often has an outsized impact on price due to its dependence on economic conditions like the boom/bust business cycle. Supply is inelastic and depends on the production capacity of mines, their lifetimes, and the expected increase of new mines coming online. This is a slower moving process and works in longer cycles than the boom/bust business cycle.

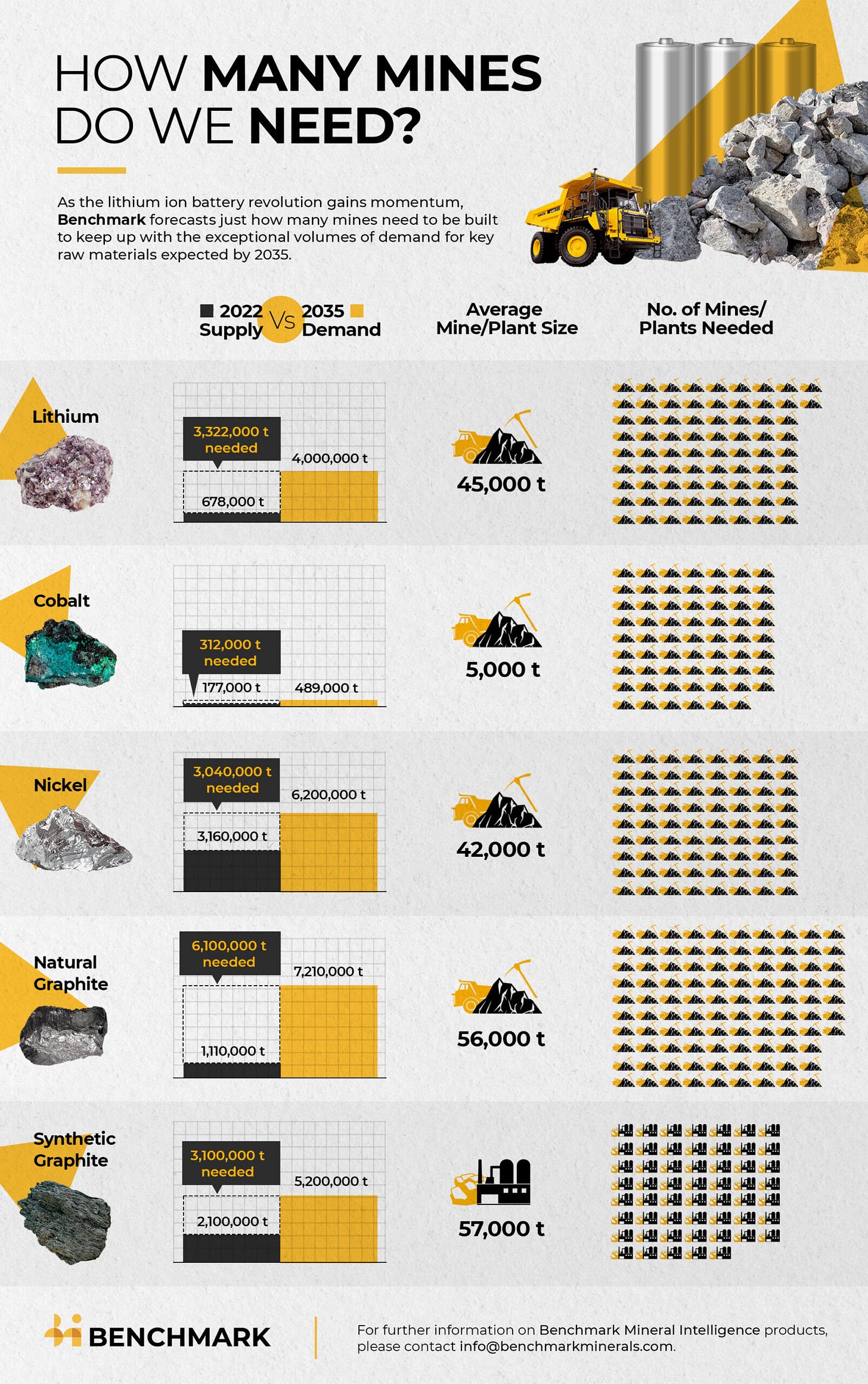

Some people’s job is estimating future demand of commodities. These people, CEOs of resource companies, and other experts in the field have a better idea of long term demand. Benchmark Mineral Intelligence has a figure showing 2022 production of battery metals, the 2035 expected demand, average mine size, and the corresponding number of mines needed to reach these targets. Each battery metal needs 62 or more mines to be able to reach currently expected 2035 demand. The energy transition is built on on the idea that full electric vehicles will be able to take over the transportation sector emissions. In this scenario, the resource requirements are quite large. And while batteries aren’t an energy source, they are required for solar/wind storage if they are to be relied upon, reducing the EROEI of those sources further.

The average mine, including lithium and nickel takes 15-20 years to come online. There are hundreds of new mines that need to come online to reach 2030 battery targets. To reach these targets, mines needed to be started years ago at this point. This hasn’t been the case though, as there has been a lack of investment in natural resources over the last decade. Copper, needed for electric transmission infrastructure, renewables, batteries, and other electronics, is projected to be in a deficit relative to projected demand even under optimistic scenarios. Graphite is in a similar boat if the expectations for EVs plays out. In fact, the worry is there for most strategic energy metals, battery metals, and rare earths.

Either these projections of demand are too aggressive, or prices will adjust much higher. Or a third option of both, where prices go higher which kills demand bringing prices back down. “The best cure for high prices is high prices.” In addition to traditional mines to fulfill the shortfall, new methods like direct lithium extraction, deep sea mining, recycling, and other methods are being explored to solve this issue.

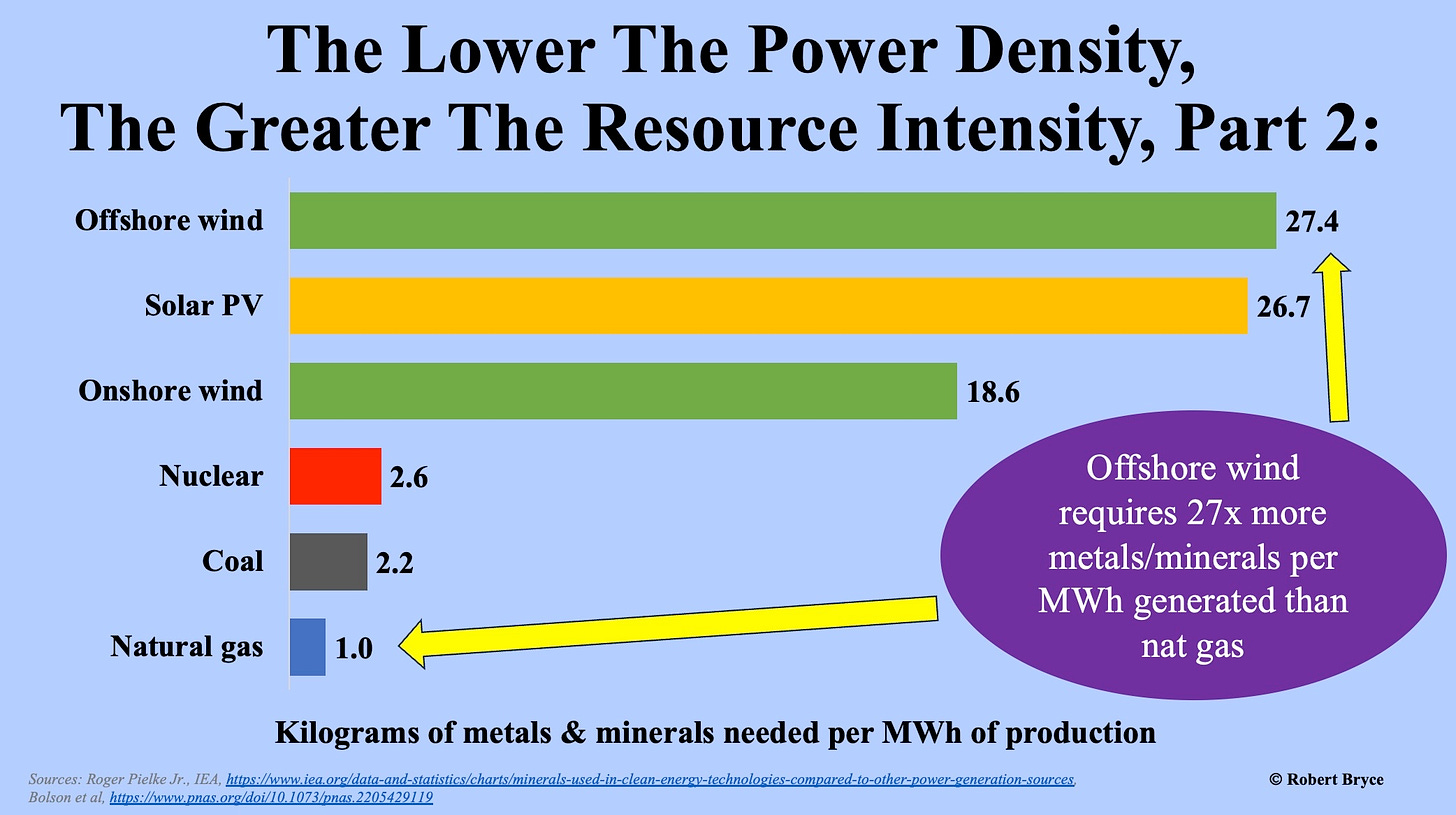

Total material requirements and the broader environmental impact are important to keep in mind in addition to EROEI, cost/economic factors, and total abated greenhouse gas emissions. While we can’t blame the lack of transmission infrastructure on renewables, there will be a lot of extra copper needed to build it out for example. Further, EVs require roughly 2.5 times the amount of copper as a internal combustion vehicle and it is important for wind and solar themselves. While copper is not a rare resource, the vast quantities expected for the energy transition raise concerns. The point here is that excluding transmission, the resources required for any clean energy technology are higher than their fossil fuel predecessors which poses a significant problem.

Capacity factor, or simply the real energy output over the maximum output is not included in the figure above. Renewables are lower and nuclear is higher than fossil fuels on average, so below paints a clearer picture of the true materials requirement to compare between sources. When this metric is taken into account, it shows that renewables take ~9-27 times as many materials as nuclear, coal, or natural gas. This is a reason why some EROEI estimates vary. When the capacity factor and other grid impacts are taken into account, there could be an overestimation of wind/solar ability, a need for overcapacity, or a need for battery storage.

In addition to the metal and mining requirements, there are some overlooked material needs. One I have written about is synthetic graphite’s reliance on fossil fuels. Another example of an overlooked material is oil for lubrication. Each wind turbine uses on the order of 80 gallons of lubricant oil which is to be replaced in a few years. Renewables are not stand alone and still require fossil fuels. Many proponents want to eliminate fossil fuels completely, but this would be unwise seeing as though biofuels and natural oils have not been made commercially competitive yet.

Renewables fundamentally aren’t good or bad, they are a tool to harness energy. They make sense where they make sense. To rely solely on them for electricity comes at an enormous material cost that either needs to be considered seriously, or we can arbitrage this opportunity as investors realizing the material impacts and arbitrary government decisions.

At the end of the day, either the supply of key resources are brought online, demand is decreased, or the price structurally increases. One or a combination of these scenarios will play out, and time will tell how. It is extremely difficult to see a significant number of mines being expedited or mines being started in the US. The government will continue to fund mines in other countries, but their ability to push this through is limited and is less under their control. This means that we should expect structurally higher metals prices into the future, meaning the disinflation of metals in 2023 will not continue indefinitely. If and when these costs translate into the everyday life of people in the form of car cost and energy costs, at some point there could be a point where people are not content with this prospect. This won’t happen in a straight line. Just as we are seeing prices of metals going down now, economic deterioration or recession can bring about severe disinflation in natural resource prices as demand for goods and new investment slows significantly. Further, we see significant change in climate policy among political parties. These two factors convolute this trajectory, but higher metals prices is ultimately is where I think we go. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at twitter @graysonhoteling and check out my latest post on notes.

Let someone know about Better Batteries and spread the word!

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Email - betterbatteries.substack@gmail.com

Archive - https://betterbatteries.substack.com/archive

Subscribe to Better Batteries

Please like and comment to let me know what you think. Join me by signing up below.

Thanks for the interesting read. But it does seem to suffer from the "things will remain as they are" assumption. Do you really think that's the case? Just one example, the enormous shift away from nickel-manganese-cobalt (NMC) batteries to more lithium-iron-phosphate (LFP) based ones just in the last 2-3 years. That comes with other pros/cons, but technology replacement and innovation is such a huge part of the battery space that it seems a bit shortsighted not to address that here.

"At the end of the day, either the supply of key resources are brought online, demand is decreased, or the price structurally increases." Or the technology evolves to use cheaper materials, or improves the use of the current ones, or creates new/better anode and cathode materials, etc. Granted that's hard to quantify or predict, but we've seen it already and I wouldn't be so confident that we are in for higher metal prices into the long future.

Solid state batteries should at least help the lithium supply problem. A popularity shift to smaller cars might help instead of dragging around so much unused capacity like we currently do, at least in the US.