The Great Transfer

Kids may inherit the house, but not the wealth.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

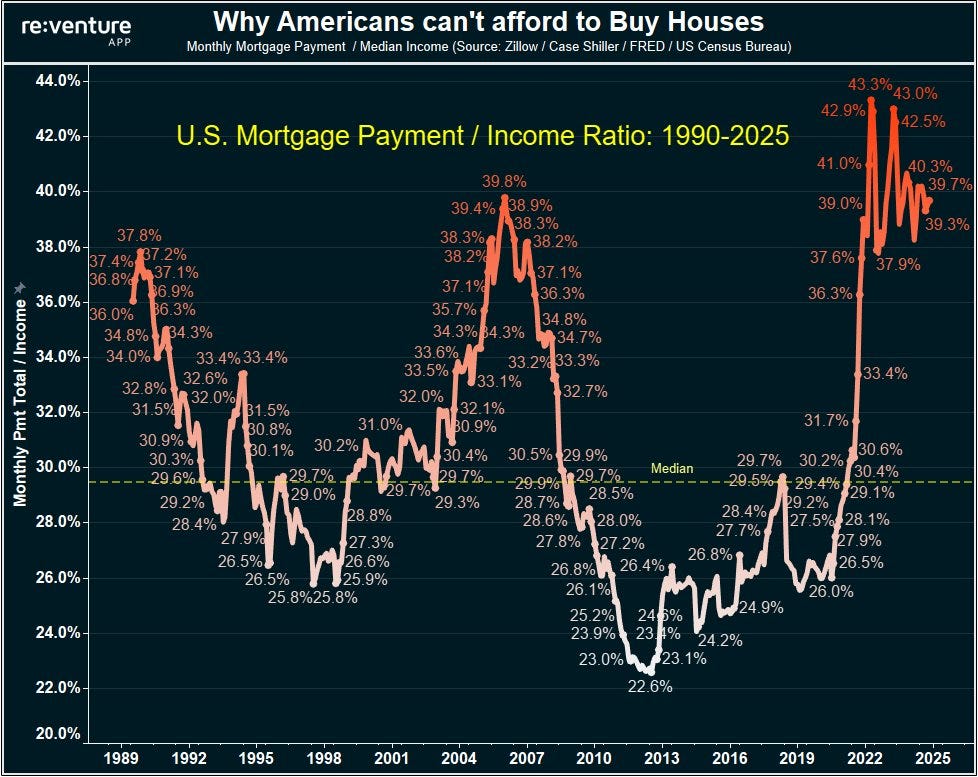

Buying a house is one of the most important milestones in young families’ lives. Recently, young Americans have been having a hard time affording homes. Some believe there are structural factors handicapping millennials and Gen Z. Others think that it is as simple as budgeting and lifestyle expectations. The complicating fact is that both can be true. Perhaps young people need to buckle down, live below their means, save as if their lives depend on it, and ignore social media. Even with this lifestyle change, comparing housing costs to average incomes paints a bleak picture for affordability.

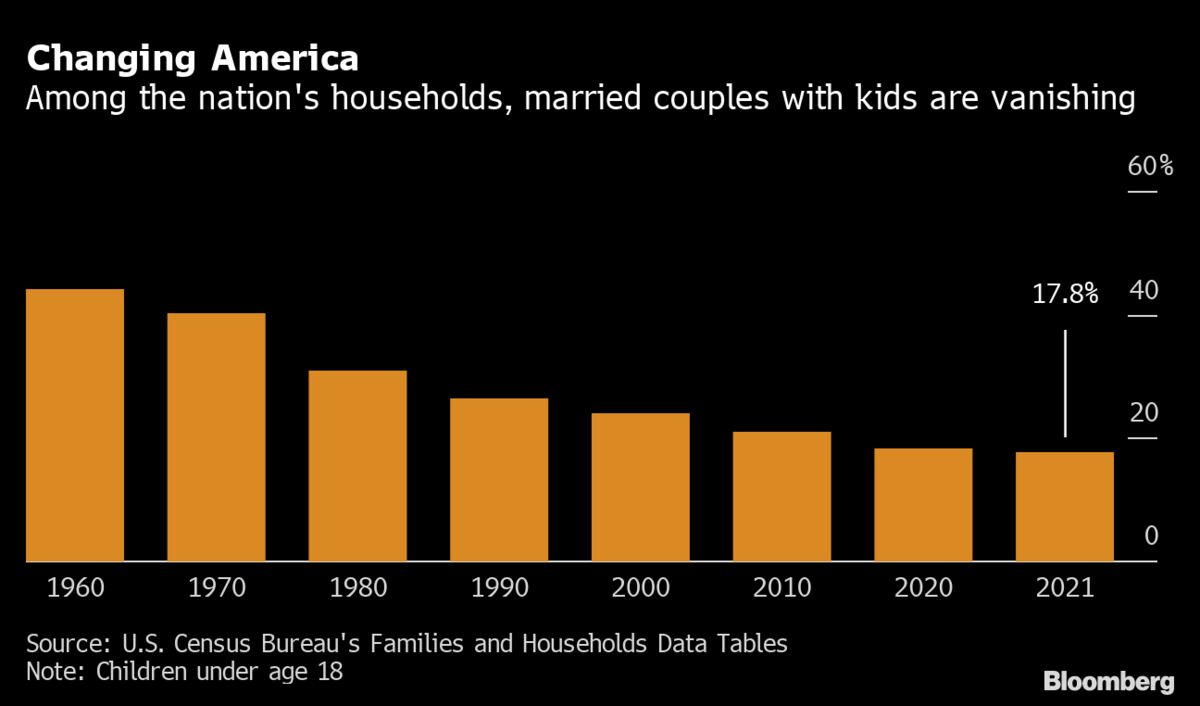

So who’s buying homes? The median age of all homebuyers in 1981 was 31. As of 2023, it was 49. Some have claimed there are more home sales from > 70-year-olds than < 35-year-olds. The US demographic picture is an aging one. The share of eldery to the working age population is increasing. Some can be chalked up to that, but it is not a healthy long-term trend. Formative early years for families to buy homes, have kids, and secure careers to grow the economy are being delayed. The percentage of married households with kids has been cut by over half since the 60s.

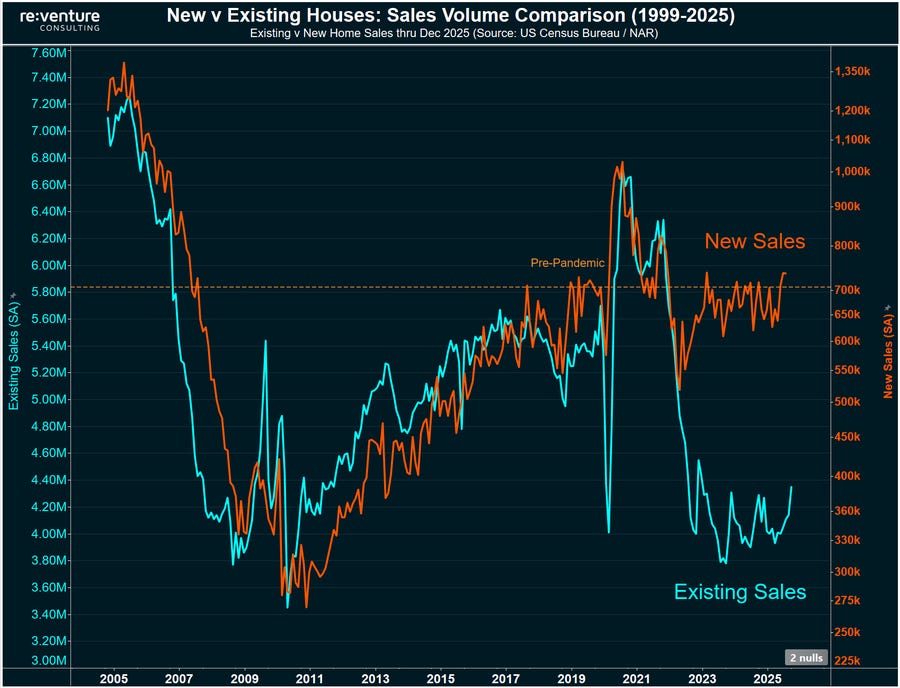

One striking divergence is between new home sales and existing home sales. Historically, these have tracked each other in relative movement. The new home sale market is much larger than new, but new home sales have remained steady post pandemic, whereas existing home sales (the bulk of transactions) have dropped significantly.

The reason is that new homes are cheaper than existing homes now, which doesn’t make sense. This is because homebuilders need to turn over inventory. In order to do this, they are buying down mortgage rates or selling for discounts in order to move houses. People selling homes (the existing home market) have not woken up to the fact that the market rate for their houses is already lower than they think.

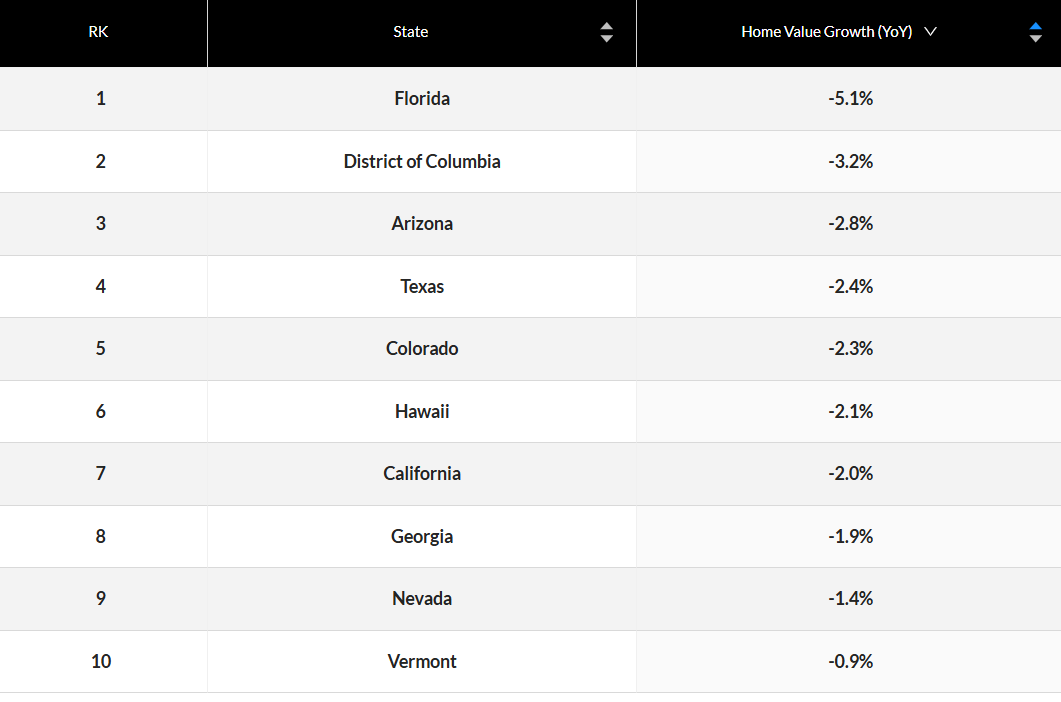

The housing market has not crashed, but the bubble has popped. The US is currently split, with some states increasing prices and others showing declines. Florida, Arizona, Texas, and Colorado have seen significant price declines in housing already. It is regional, but I think that housing prices will come down further in the looming recession.

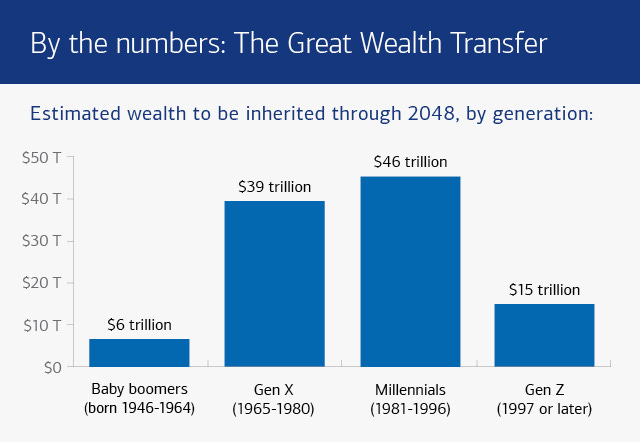

Many argue not to worry, as the boomers, with all the wealth, will transfer these assets over to younger generations. Tens of trillions in housing are expected to be transferred to younger age cohorts in the coming two decades. I do not share this optimism, unfortunately.

First, the wealth people feel from their houses going up in price is phantom value. If you cannot afford to move into another house in your same neighborhood, your house isn’t worth what you think it is. Further, if your house went up the same as everyone else, you did not get any wealthier. Housing, like stocks, is in a bubble of overvaluation. Like many mathematical series, mean reversion is a question of when, not if. Mean reversion in the housing market would bring down housing prices nationally by 20%, in some areas, more, and in others, less. 2007 and for a brief moment in 2022 were the last times home prices peaked from overvalued levels. March 2025 was the current peak, and prices have since been in decline.

If ‘boomer’ wealth were cut by 20% from housing and an additional haircut in stock assets, there wouldn’t be as much wealth left to transfer. Further, demographics and current trends suggest that the demand and price of elderly care will increase. Much of this ‘boomer’ wealth will also be siphoned by healthcare companies. You may have feelings about universal healthcare, breaking up corporations, or other ways to solve healthcare issues, but the reality of supply/demand suggests there is more demand for elderly care than ever before due to demographics. For every extra $100/$1000 reluctantly forked over to retirement homes and hospitals is money not transferred to the next generation.

Something must change for young people to get into houses and start their lives. That is already happening, and it is prices coming down. This will be good news for younger generations, but terrible news for current asset holders. The biggest asset most people own is their house, and there is currently a nationwide hallucination that houses are worth more than they really are.

Of course, this is not the mainstream view, and instead of letting market forces work, brilliant politicians are proposing other ways to get people into homes. This comes in the form of previous strategies like lowering lending standards and increasing government programs. They are getting more creative these days, too. The Trump administration has proposed a brilliant new way to afford down payments, by allowing 401k balances as collateral. While the details are yet to be proposed, what happens if the stock market goes down 20%, do you lose your house?

Overvalued assets will have a reckoning at some point. That means stock prices and housing. Housing hits closer to home, as that determines much of household wealth and family creation. Many believe the younger generations will simply inherit the wealth of the older ones in a smooth transition. I argue that wealth will be destroyed through deflation and elderly care, which will not be as pleasant. Younger generations won’t get into houses until prices come down further, much further. It has already begun. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

Everyone has been so desperate to pay whatever price they have to to buy a house the last decade. The irony is, if your scenario plays out, there will be a glut of houses much cheaper that no one will want to buy.