To Good To Be True

Financial freedom for retail investors or something else?

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

In June 2024, the US Court of Appeals overturned an SEC ruling relating to private equity (PE). This decision reduced regulations and opened up private equity firms’ ability to market and sell products to a wider swath of consumers. Before, private equity deals were solely for large companies and high-net-worth individuals. Now there is a new player in town: the retail investor. Less regulation and greater freedom for the average investor is a good thing, right?

What is PE

Instead of buying publicly traded stocks, private equity deals are investments in private companies, which require large amounts of capital and specific credentials. Private companies tend to be riskier, but can often yield much higher returns. Without regulated financial transparency, there can be an added layer of opaqueness to PE deals. These companies do not have to report financial statements as often as publicly traded companies do, which allows for less volatility in the price/valuation of the company.

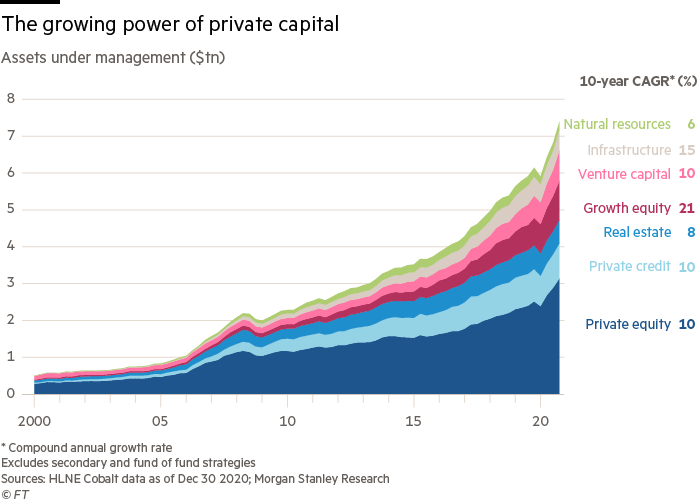

While venture capital focuses more on early-stage companies, private equity, at large, has focused on taking growth companies public in recent years. Large investment companies like BlackRock or University endowments like Harvard may invest during one of the funding rounds A-D. The goal is to help the company grow and then sell ownership at a later round or once they go public through IPO. PE has seen staggering growth since the great financial crisis, with a zero-interest rate policy pushing investors further out on the risk curve to get returns on their capital.

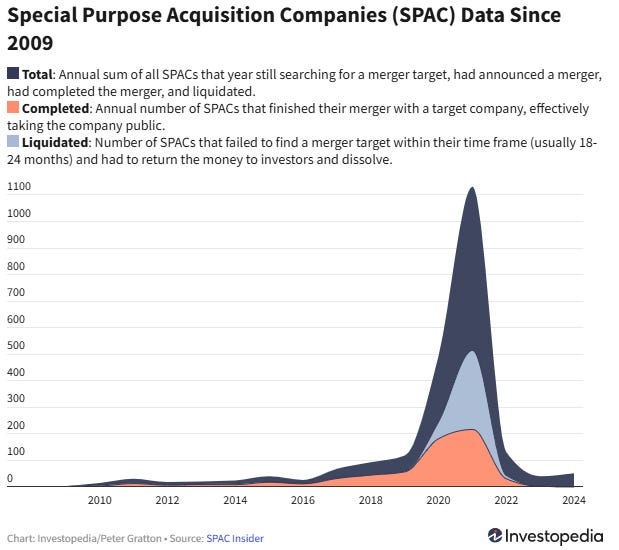

In addition to the standard path for companies going public via IPO, SPACs also thrust into popularity after COVID, only to die down once the Federal Reserve began hiking interest rates. SPACs allow companies to go public much more quickly in the US and have resulted in many speculative companies being pushed onto public markets in that time.

Retail Investors

Unless you are a high-net-worth or professional investor, retail investors have infamously been unable to access private markets for decades. Now, private equity is open to retail investors in the form of ETFs. In theory, this could give investors access to these improved returns in the private market and not be subject to the same volatility as the traditional stock market.

While nice in theory, I would warrant caution when looking into these exciting new products. These investment companies, like BlackRock, are in the business of selling you a product to get money out of your hands. This is a shiny new industry promising lucrative future returns like AI, robotics, biotech, etc, which they will use to collect fees on their ETF.

Second, if BlackRock expects to outperform the stock market on a lucrative private deal, why would they sell it to you now? It would be in their best interest to hold onto it and let the value appreciate before selling it at a later date, which would make them more money. In reality, they are going to dump their bad companies onto retail customers, while keeping the good ones all for themselves.

These companies will do whatever they can to drive more capital inflows. If their traditional funding partners are cutting back on investments, perhaps retail could provide the juice. Readers of my blog will know where the lucrative capital flows are right now: 401(k)/target date funds. PE firms are lobbying to be included in 401(k)s, and many think the Trump administration will sign off on it. If higher returns for less volatility right there in your 401(k) sounds too good to be true, it probably is.

Final Thoughts

Generational money can be made in PE. In theory, retail investors accessing these companies is a good thing, but we are not likely to get sold the cream of the crop. In reality, PE firms are dumping their losing companies onto the retail investor to mitigate their losses and improve profits.

In addition, there are warning signs that the industry isn’t as healthy as it seems. Just like housing seemed bulletproof to most investors going into the 2008 Financial Crisis, most investors view PE as safer than the public market. While SPACS have slowed down, it showed the froth and low quality of companies they were promoting and bringing public.

Further, speculation and overvaluation have squandered many firms’ ability to reach the needed returns, which may only get worse given elevated recession risks. If everyone is winning, it’s probably a bubble. PE was and could still be in a bubble alongside the whole financial markets, which have been humming along okay, for now.

Finally, the larger the industry grows, the lower the expected returns will be. This could be why endowments like Yale are selling billions worth of their PE portfolio in what they see as a changing investor environment. 42% of the Russel 2000 small-cap stocks are unprofitable and increasing over time. Most private growth companies are also unprofitable and may not fit into their valuation, causing issues someday. A black swan event is something that no one expects to be a problem. The private equity bubble at least has the ingredients. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

Caution can always be wise. Good advice. There are always reasons for deals too good to true. We retail investors are loath to shed our losers. Thus we can lose even more. The big guys understand that too well but are happy to help you down.