U Say Something?

The other yellow rock may have a bright future.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

If you were asked what the most important energy source in the future is, what would you say? Your answer may depend on your political leanings: Fossil fuels or renewables. Another source stands out, unconcerned with these debates. Nuclear energy is a staple in the US, providing 21% of the grid’s electricity. As I discussed in What’s Up With Nuclear, it has become safer than its reputation suggests, is orders of magnitude more energy-dense, and has some exciting technological developments.

One important takeaway from that piece, given geopolitical tensions, is the foreign dependence of uranium oxide and refined uranium fuels. Nearly 100% of uranium oxide, high-assay low-enriched uranium (HALEU), and 80% of low-enriched uranium (LEU) come from foreign suppliers.

Last month, the Department of Energy announced $2.7 billion to strengthen domestic enrichment over the next ten years. Deglobalization trends and geopolitical tensions have brought new demand for metals for strategic purposes.

The bullish case for uranium prices comes down to supply and demand. On the demand side, you have geopolitics/deglobalization, data center/AI, increased global interest in nuclear, nuclear powerplant extensions, and bipartisan support. On the supply side, you have questions as to whether current supplies can manage and how quickly new supply comes online.

The largest uranium miner in Kazakhstan, Kazatomprom, announced a reduction in their forcasted mining quantity for 2026, despite the rise in prices. Other uranium mines are relatively small and take time to come online (AZ, UT, and more), leaving the supply potentially unable to keep up.

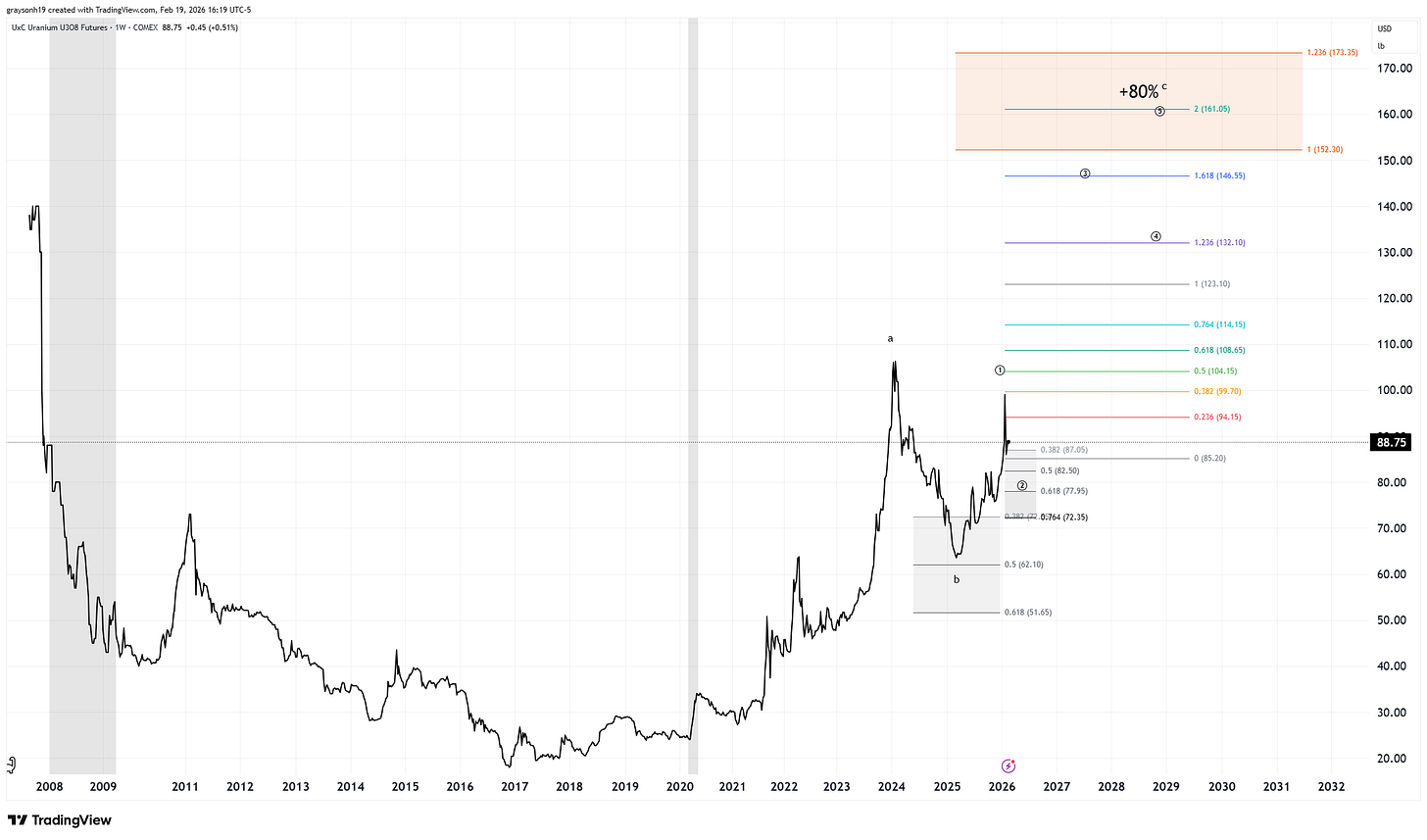

Technically, uranium oxide prices have strong bullish momentum. While pulling back from recent highs, a breakout could see prices as high as $150/lb. This is a conservative estimate; if impulsive, the price could go as high as $300. The b-wave correction into the spring 2025 low retraced in the standard support region. If my analysis is correct, we are in the c-wave higher now. On the smaller time frame, there is a 5-wave move within the c-wave. Wave 2 could come as low as $72 and still be in this bullish scenario.

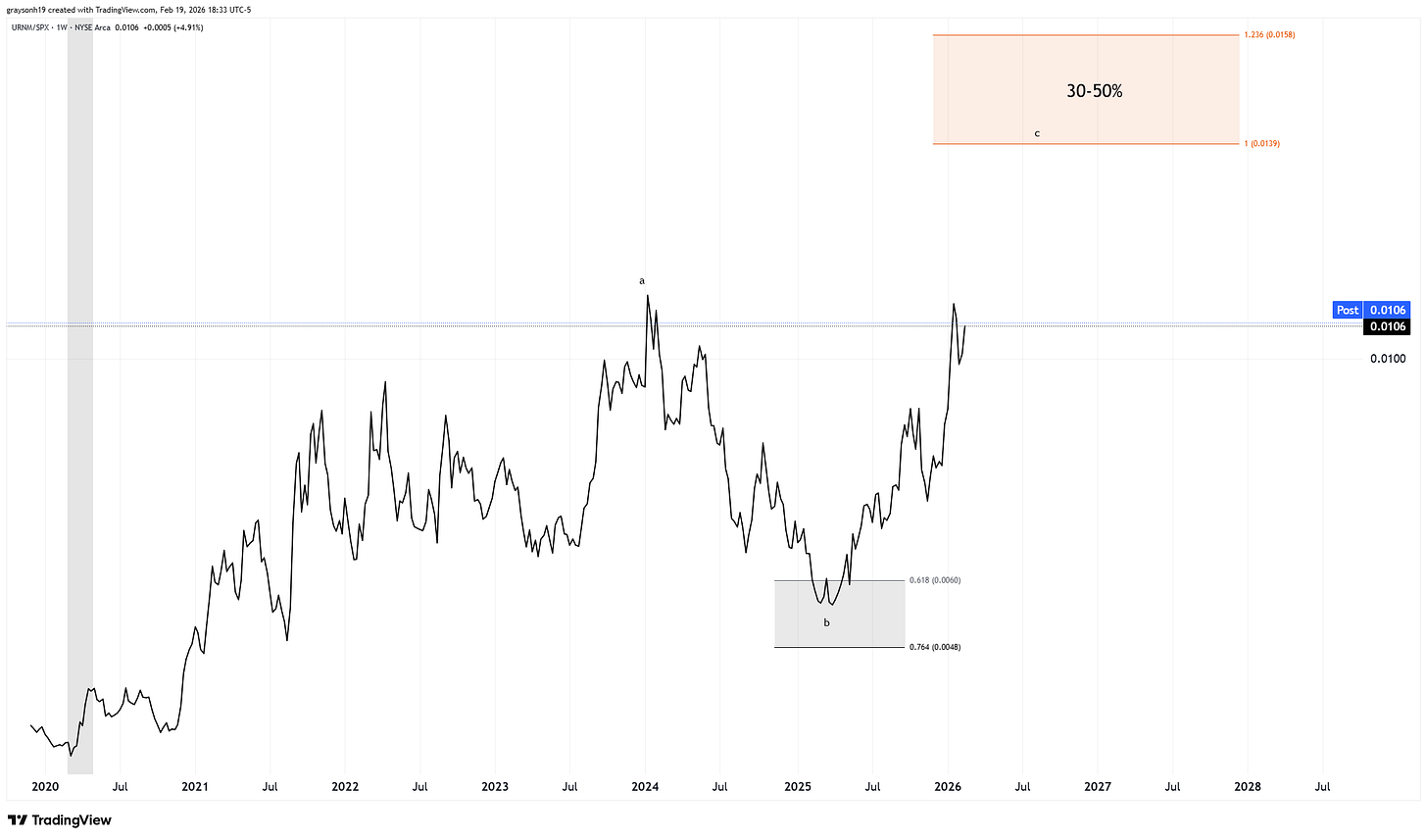

Uranium mining companies (URNM) in the model portfolio have also been in a bullish price pattern. We are very possibly in a strong circle wave-3 higher with a target around 105.

URNM, compared to the stock market (SPX), did well last year after a poor 2024. If it can continue this trend, it too could make a move higher. Conservatively, if it can break out like it is testing, the ABC would target a 30-50% outperformance relative to the stock market.

This bullish case doesn’t have to happen, but there are fundamental and technical reasons why it can. If a nasty recession strikes sooner rather than later, most assets get liquidated under that scenario. The price of uranium and stocks got pummelled in 2008. Whether uranium and the mining companies are a good investment from today remains to be seen. In a world of expensive assets, it is a good option. Regardless, nuclear energy remains a developing story and is poised to be an even more vital energy source going forward. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView