Model Portfolio: January 2026

Uranium rocks and a new entrant.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

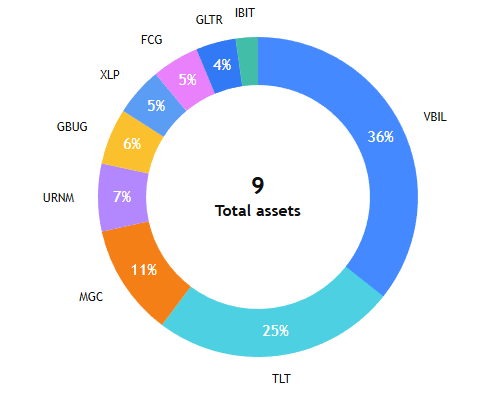

The model portfolio started in March 2025, publicly tracking in July 2025. It has 5 main components: stocks, bonds, cash, precious metals, bitcoin, and a flex option. Based on macro risks and trends, last month’s construction has been: (see more details here). [Updated allocations at the end]

Stocks - MGC, XLP - 12%/5%

Treasury Bills - Vanguard 0-3 Month Treasury Bill ETF (VBIL) - 30%

Treasury Bonds - iShares 20+ Year Treasury Bond ETF (TLT) - 25%

Bitcoin - iShares Bitcoin Trust (IBIT) - 5%

Precious Metals - Metals Basket + Mining Companies (GLTR, GBUG) - 7%/10%

Flex - Sprott Uranium Miners ETF (URNM) - 7%

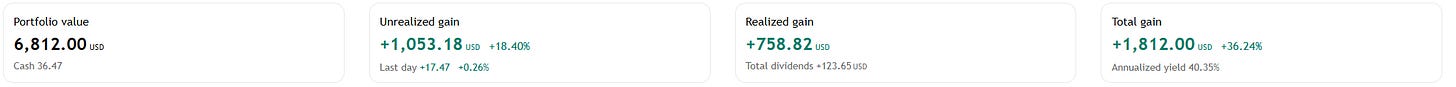

I hope everyone is having a lovely January and new year! Over the last month, the portfolio is up 7.84% vs 1.6% for the SPX benchmark. Overall, we are up 36.2% vs 19.24% for the market. Thanks to precious metals, we have been able to generate this return while the portfolio has been 55% cash/bonds.

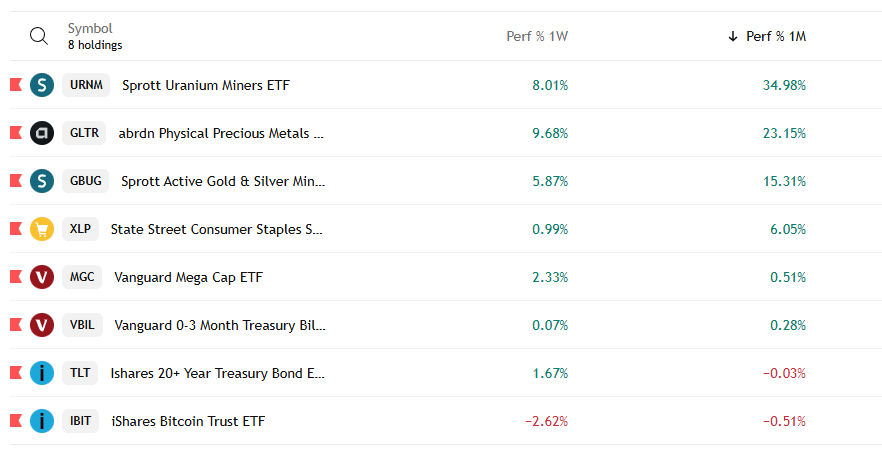

The decision to add URNM was timely and has immediately paid off, up 35% in one month.

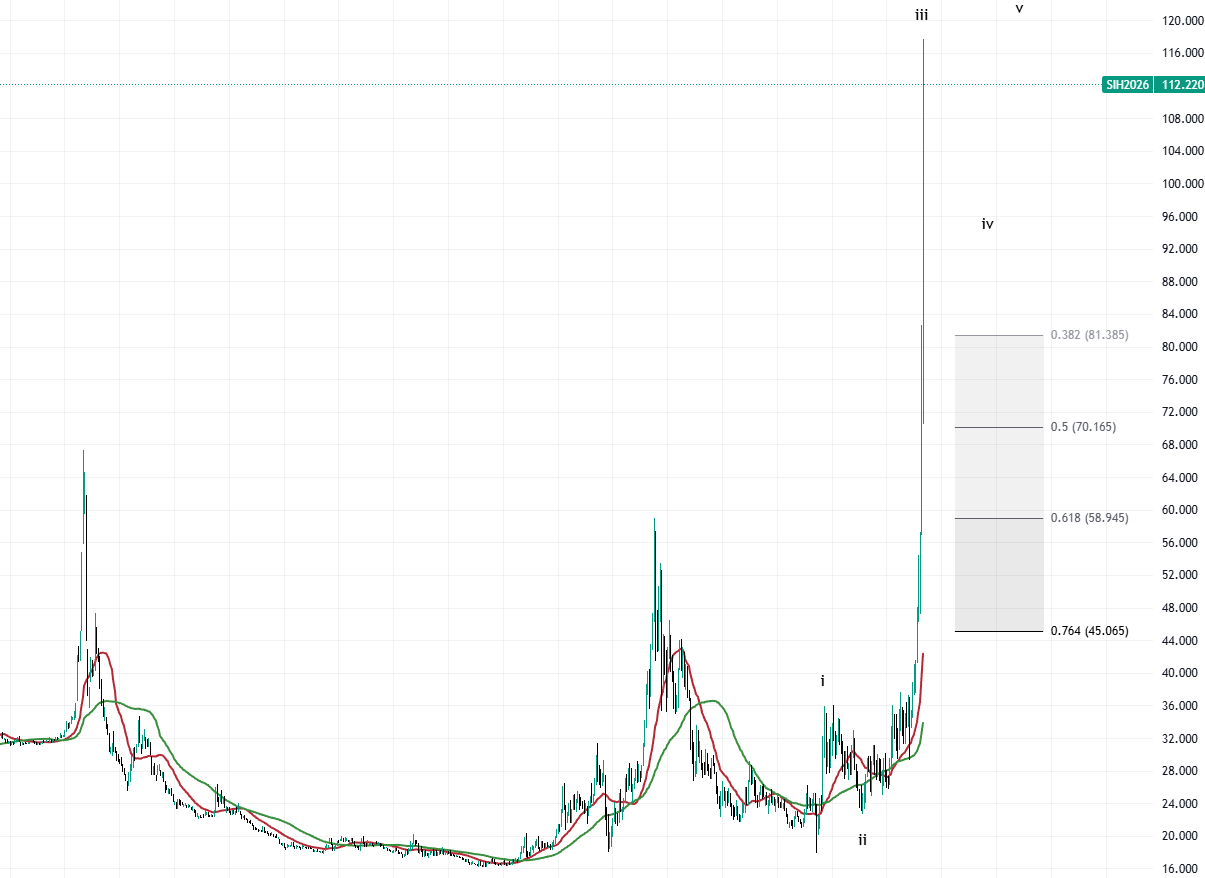

The chart shows a 1-2, 1-2 setup, which may lead to a nice wave 3 higher. Initial targets if it impulses higher are 69-73, and longer-term targets over 100 if it plays out. - December Update

Our initial wave 3 targets for a breakout have been hit already, warranting some profit-taking/rebalancing. However, if the sector is truly in a large impulsive breakout, we could see targets as high as 105-126. These are larger wave degrees and may take some time to play out if they do.

Even after taking some profits, precious metals continue their skyrocket higher, also returning 15%+ in the portfolio over the last month (GLTR, GBUG). Since January 2024, silver has risen 4.3x, from $27 to $117. This is a chart that should not make us greedy, but terrify us. Silver has tripled twice, in 1979 and 2011. Both times, the parabolic blow off top resulted in quick 30-50% corrections. New paradigm? I’ll take more profits and reduce the increasing risk. Of course, it can keep going up, but you could blink, and it’s back at $70.

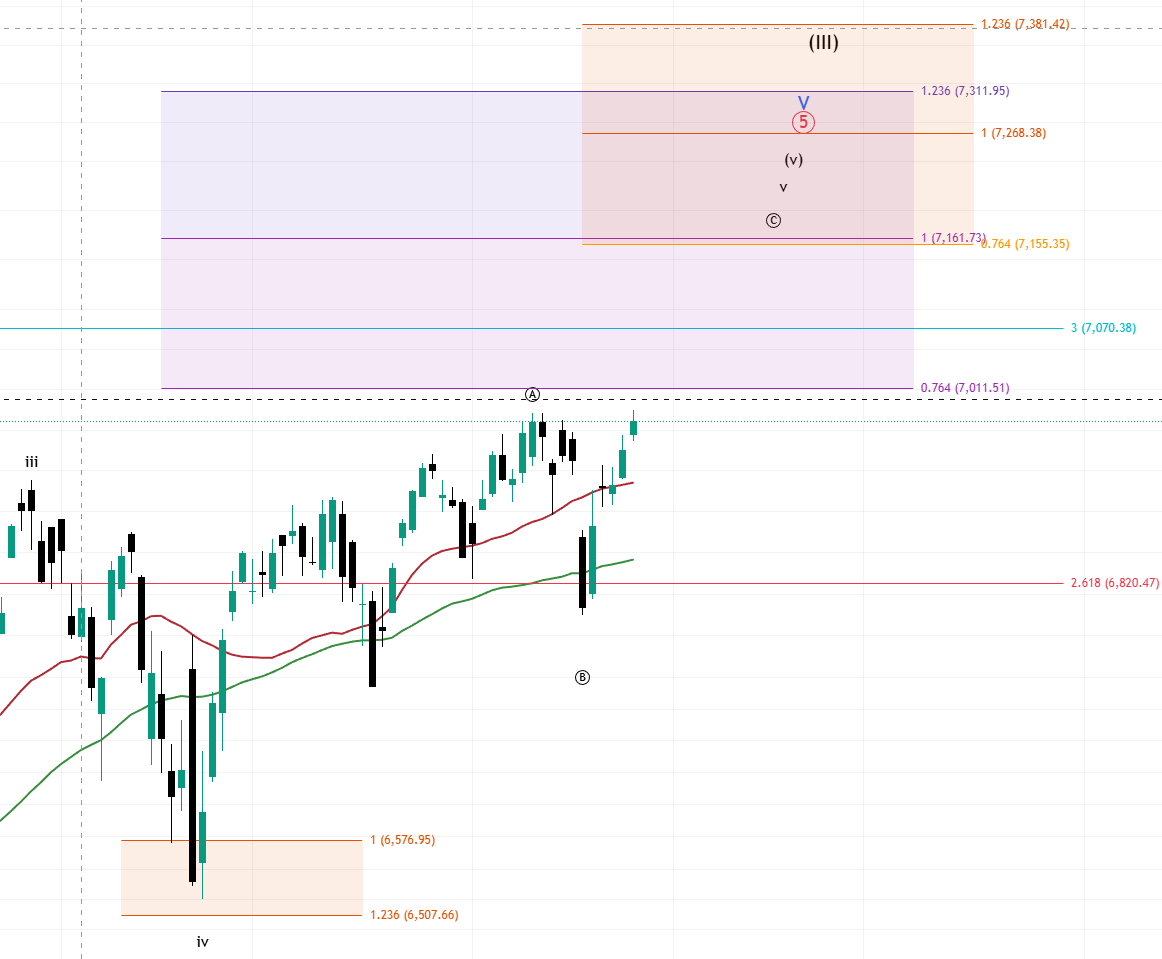

My macroeconomic outlook shapes my portfolio decisions. Stocks, especially mega-cap growth stocks (mag 7), continue to be driven by passive investing, stock buybacks, and speculative capital inflows. Until the unemployment rate rises, thus passive flows halt/reverse, the underlying drivers of the stock market/economy mismatch will remain.

As rate cuts progress and we head into economic slowing, I have been expecting rotation into safer companies, like consumer staples (XLP). January saw one of the largest outperformances of XLP to the mag7/SPX in a while. My gut tells me we hit 7000s before the top is in, but in the meantime, we will continue to hold both MGC and XLP. We are near a large long-term top in my opinion, thus the relatively small stock market allocation.

This also spurs my decision to hold TLT. As economic growth (GDP) and inflation (CPI) continue to decrease, bond yields are proportionate to the sum of these. As bond yields decrease, this causes the Federal Reserve to cut interest rates. Mortgage rates are a type of long-duration bond, so I expect mortgage rates to come down once a recession hits. The bond price is inverse to bond yield, so TLT should go higher once this happens. In the meantime, the lagging performance is offset by the guaranteed yield of the bond each month.

Since May of 2022, long-term government bonds (TLT) have been a triangle of boredom. It is nearing the end of the triangle where a decision is likely to be made. I expect 102-207 when the economy hits the fan. However, if I’m wrong and the economy is somehow still booming and/or inflation skyrockets again, we could see the 70s (less likely in my opinion).

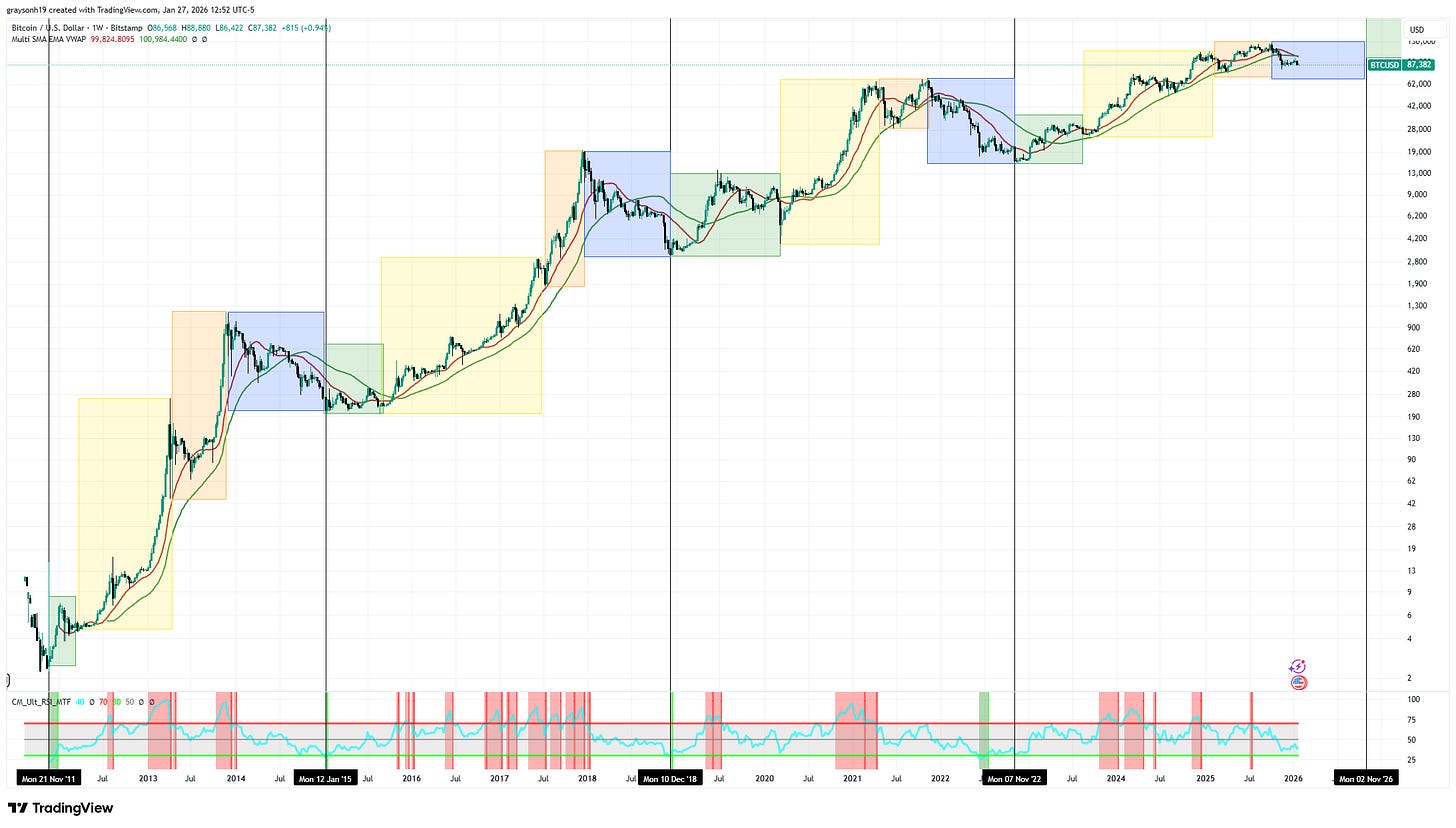

Cyclically, Bitcoin is in its “winter” period in blue, which is why we’ve downsized the position. If the trend remains, which it looks like it is, this is the worst time to own Bitcoin. There is resistance at $74k, which I would not be surprised to see. I will lower Bitcoin to a 2.5% allocation.

We are running out of things to buy, thus holding so much cash/bonds. Precious metals have gone up so much that the risk is increasing. Stocks of all types are at extreme valuations. With inflated asset prices in stocks and housing, and speculation rampant even in disruptive plays like AI and robotics, it is difficult to find value. Uranium is a good bet, but that just went parabolic, too. Bonds are boring and won’t provide any excess returns. One area that is starting to gain favor is energy.

I debated adding XLE to the portfolio for a while, but if an economic slowdown takes hold, oil prices and XLE may go down. Natural gas, on the other hand, has been in a maddening bottoming process for the last 3 years. As I’ve discussed, natural gas is very important to the global economy, and the US is very good at producing it. Even during a recession, AI/data center demand for nuclear/natural gas should help the sector. Further, exports of cheap US gas as an arbitrage should continue.

Natural gas prices just doubled from $3-6. First Trust Natural Gas ETF (FCG) is an etf that tracks the exploration and production of companies with exposure to natural gas. The companies here have much lower valuations than the rest of the market and pay a dividend yield. I am adding a small 5% flex position in FCG. Even if it does nothing, we are holding better valued companies with cash flow and dividends instead of overvalued ones.

Summary:

URNM - rebalance 9% to 7%

GLTR/GBUG - profit taking/reduction - 8/11% to 4/6%

MGC/XLP - keep at ~12/5%

TLT - keep at 25%

VBIL - increase to 35%

IBIT - reduce 5% to 2.5%

FCG - add 5%

The new portfolio target allocation:

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

It's a tough call on Silver and Gold. Technical Traders is along your line of thinking. David Skarika thinks since the junior minors/penny miners haven't "launched" much there's still upside (theory being that masses will search for bargains in this parabolic move). He hesitantly recommended selling 10 percent of positions which I'm starting.