What's Up With: Natural Gas

The future of natural gas in the US.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

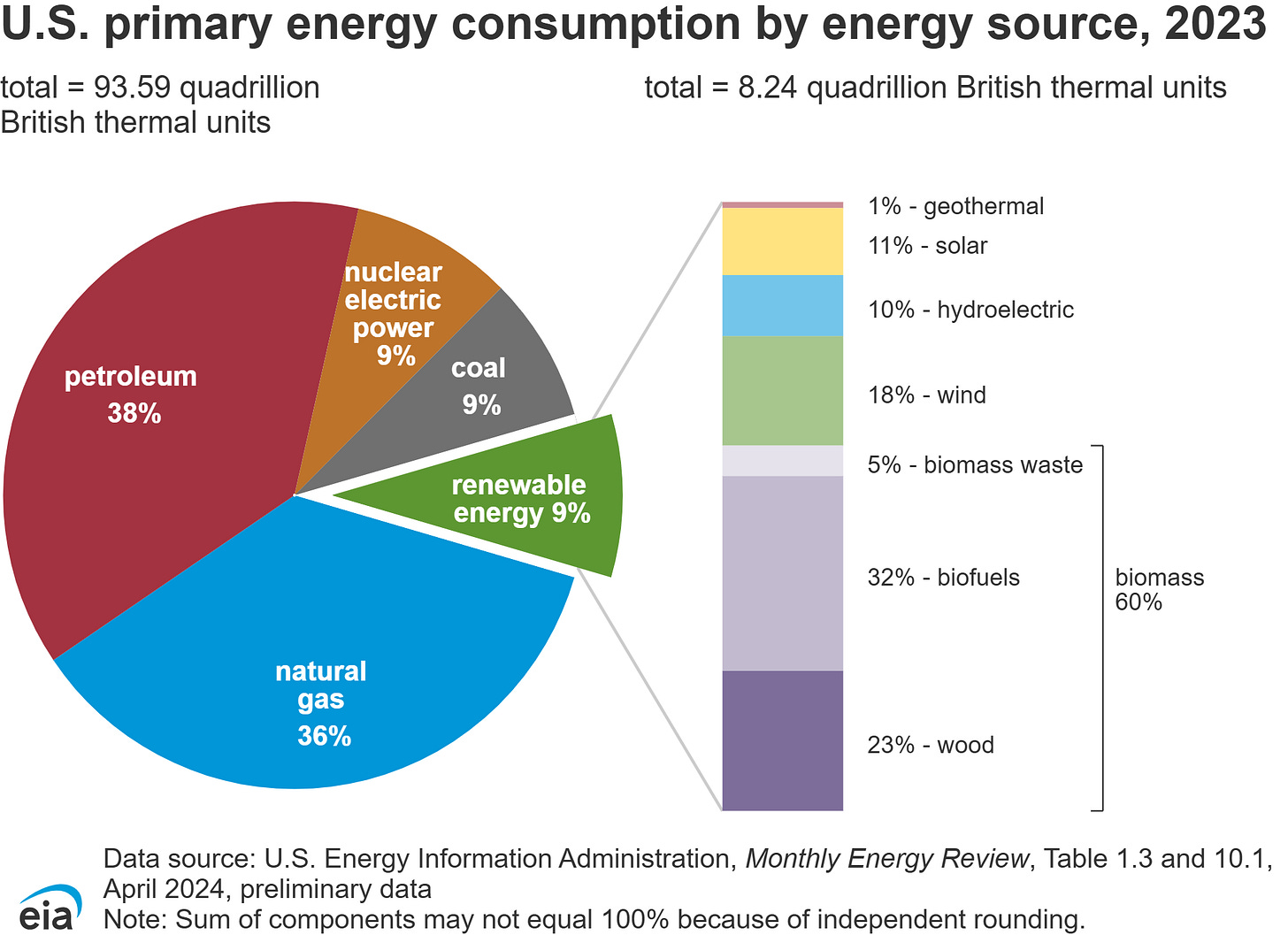

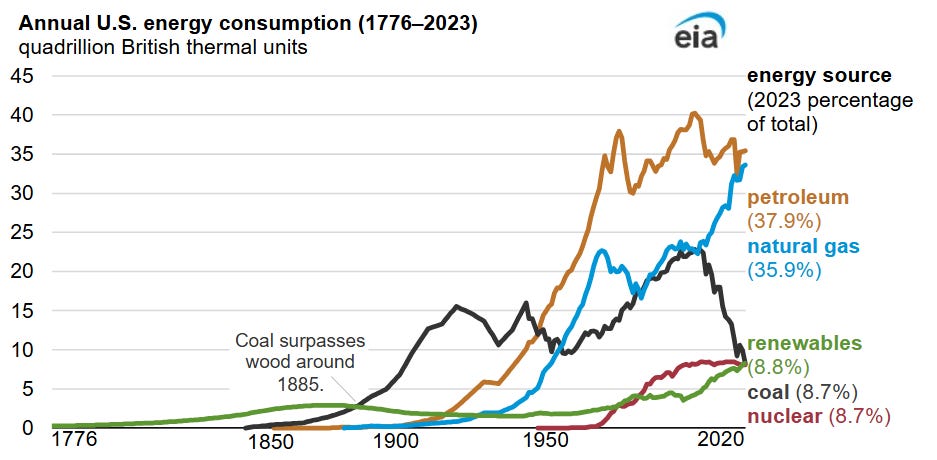

Energy consumption encompasses more than just electricity. While renewables accounted for 21% of electricity in 2023, they only account for 9% of total energy consumption. This also includes transportation, heating, and industrial use. While it would be nice to have a perfectly sustainable grid, the reality is different. In this series, I will highlight the roles of various energy sources and their outlook. For the year 2023, fossil fuels accounted for 82%, nuclear 9%, biomass 5.4%, and renewables 3.6%.

This is a series I’m going to do where I will research and update my outlook on each energy industry: renewables, batteries, nuclear, and fossil fuels. This week is about natural gas.

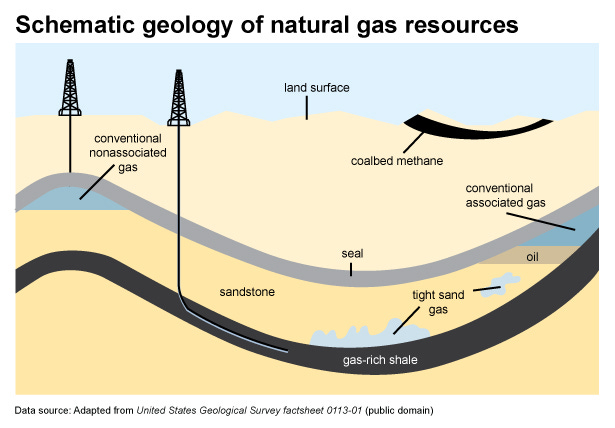

Natural gas is produced by drilling wells, just like oil, but it is a gas rather than a liquid. For many years, it was simply a wasted byproduct of oil drilling, which was flared or vented out. Natural gas is methane, which is an even more potent greenhouse gas than carbon dioxide, so efforts to flare instead of vent the gas became more common.

As energy prices continue to rise, new energy sources may become viable. Most importantly, the shale oil revolution is what really drove the economic viability of natural gas. New drilling technology, specifically horizontal wells, at the turn of the century, made many new methane reserves economically viable. Today, there is a good chance your home or business is powered directly or electrically from a natural gas power plant.

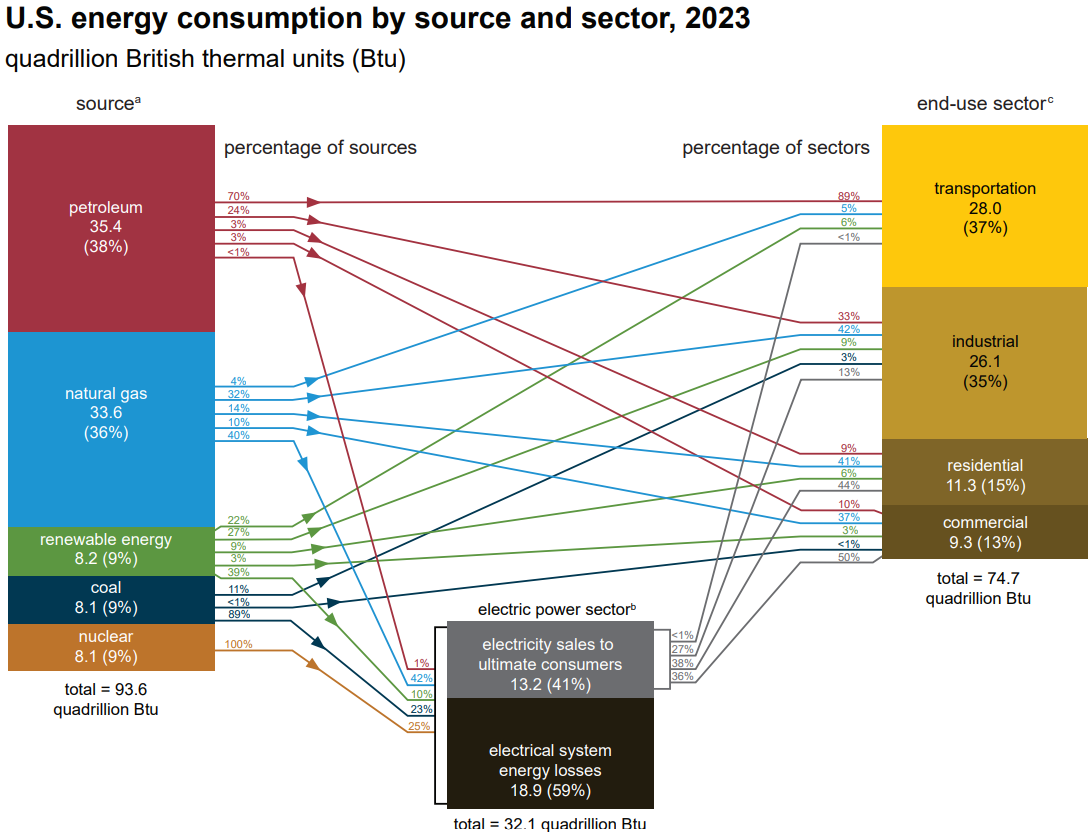

Last time, I discussed oil, which is used primarily for transportation and less for industrial, residential, and commercial end-use sectors. Making up nearly the same percentage (34%) of total energy in the US, natural gas is used in contrasting sectors. Technically, natural gas engines are used for transportation in some applications/countries, but it is less common due to the additional engineering challenges and the vast market for traditional vehicles in the US. Instead, natural gas does what oil doesn’t: power homes, businesses, and commercial properties. The majority of residential and commercial power comes from natural gas, as well as 50% of industrial power.

Perhaps unsurprisingly, the US and Russia produce the most natural gas, with a large gap to Iran, China, Canada, and Qatar. Countries like Iran, China, and Saudi Arabia are primarily domestic consumers, whereas the US, Russia, Qatar, Norway, and Australia export significant quantities.

The EU, Japan, China, South Korea, and the UK are the largest importers of this liquefied natural gas (LNG). Since it is a gas normally, it has to be compressed into a liquid and decompressed at its final destination. This process adds additional complexity and cost, but it is worth it for many nations.

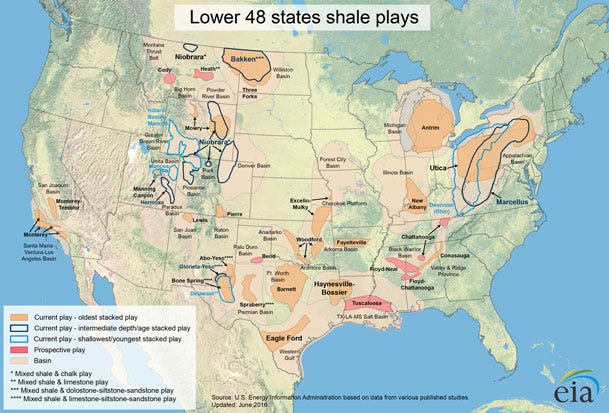

In the US, two main regions lend themselves to gas production and LNG exports. The southern region (Permian and Haynesville region) is the top gas producer, consisting of Texas, Oklahoma, New Mexico, and Louisiana. So much gas is produced here that prices have been very low, even outside the pandemic. Low prices and excess production mean companies may opt to flare the gas. There are existing and under-construction LNG facilities in Louisiana and Texas to take advantage of export arbitrages, which is where most of the gas ends up.

The Marcellus shale region is the next largest production region, consisting of Pennsylvania, Ohio, and West Virginia (New York voted against fracking). Gas from here is primarily used for local power markets, as environmental permitting for new pipelines has proven very difficult for the northeast/mid-Atlantic regions. Ironically, states like Massachusetts import significant quantities of expensive LNG instead of getting cheap gas from a mere few hundred miles away. The first issue is the lack of pipeline infrastructure and the lack of political will to build new pipelines. Second, the Jones Act forbids LNG shipments from the Gulf Coast or Maryland to Boston. Instead, shipments come from Nigeria, Trinidad and Tobago, and Russia at a higher price tag. This is one of the main reasons electricity prices in the region tend to be higher.

On the climate front, there are heated arguments on both sides of the aisle. As you would expect, the left opposes all things fossil fuels, including natural gas and LNG exports. The right cares little for emissions, encouraging drilling and LNG exports. Biden paused decisions on new LNG terminals (ones under construction continued), whereas Trump reversed this and allowed new applications. Politically, the northeast situation is funny as it would actually reduce emissions and prices in the region to build gas pipelines in the region instead of compressing it, shipping it from across the ocean, and decompressing it again.

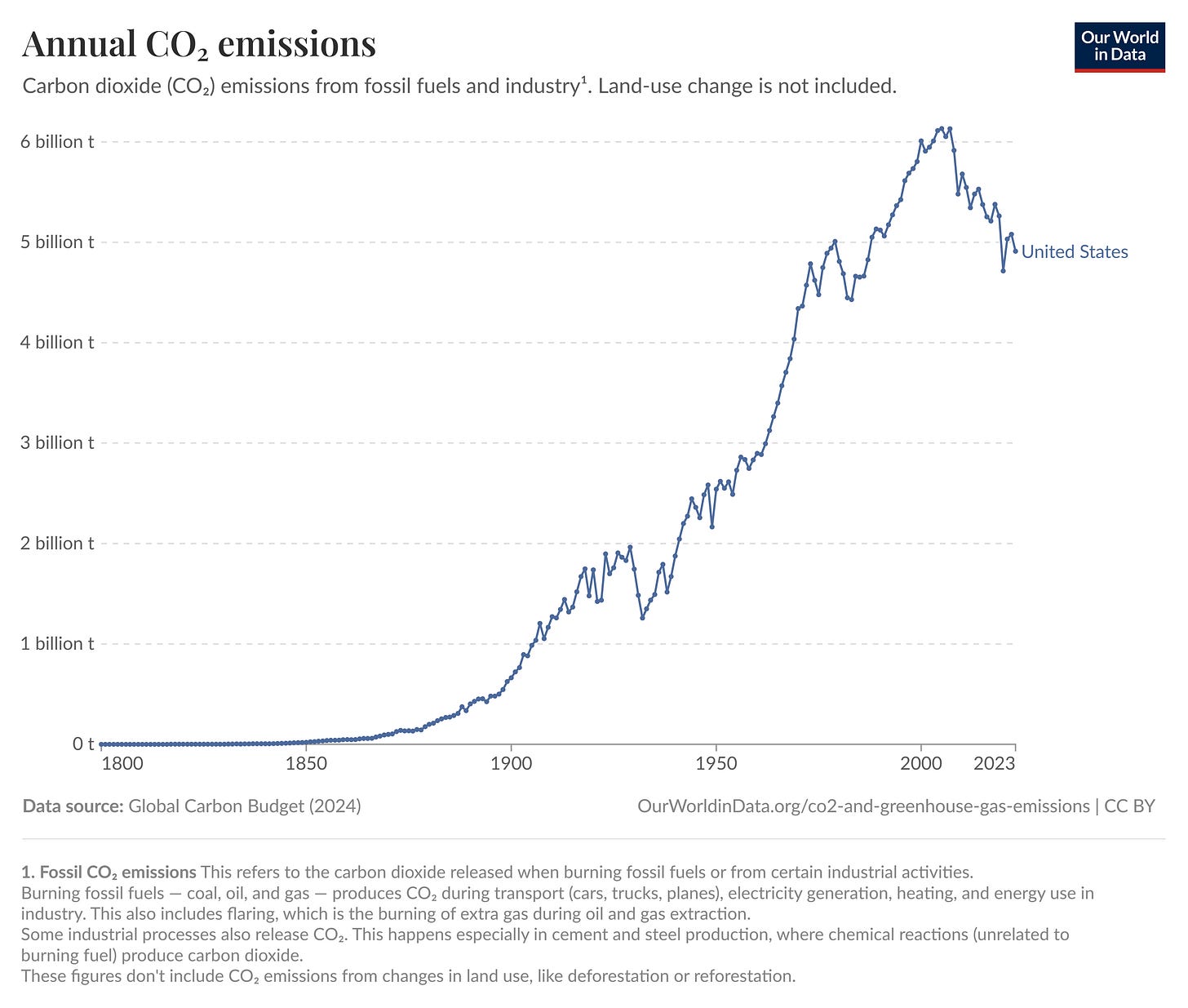

Natural gas is also sometimes considered a “bridge fuel” politically. This means that while still contributing to emissions, it is cleaner-burning than biomass, oil, and coal. You can see this in the annual emissions over time. As you can see, since the year 2000, US emissions have fallen considerably. One argument is that the offshoring of industry could explain this. While certainly a factor, overall energy consumption remained flat. You would expect emissions to also remain flat in this case, but they decreased to a greater extent.

The next argument is that renewables may have caused this change. Since 2000, renewables have increased from ~5% to 8.8%. Like I discussed in my renewables piece, this constitutes a relatively small change, even if it is making a slight difference. The main driver of this is the transition from coal to natural gas, as you can see clearly below. Natural gas moved from 22% to 36% of overall energy consumption. Even though it also releases emissions, it causes nearly half the emissions of coal. Natural gas has successfully driven emissions lower, and could do so in other countries that use coal. In this sense, the bridge fuel argument is a good one, and increasing US LNG export capacity would, in fact, reduce global emissions likely at a quicker rate than renewables.

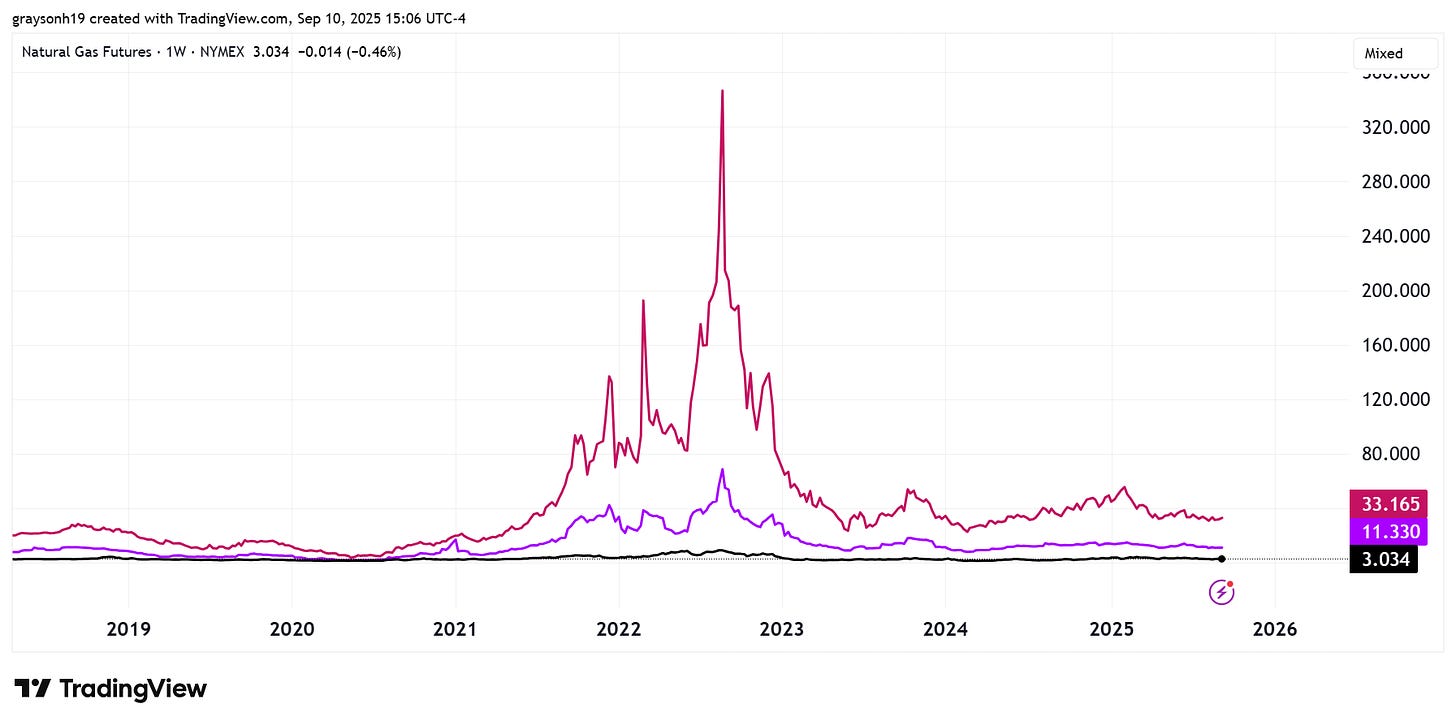

Oil is a unified global market with similar prices worldwide. On the other hand, natural gas prices fluctuate wildly based on geography, giving rise to immense export arbitrage. Currently, prices are $3 in the US, $11 in Asia, and $33 in Europe. Asia and European markets are heavily reliant on imports, whereas the US has bountiful domestic production. The Russia-Ukraine war and Nordstream pipeline sabotage in 2022 caused a crisis in European energy markets. It has since moderated, but a significant US to Europe price arbitrage remains.

Just like oil, one thing is for certain: natural gas isn’t going away. Demand for residential and commercial heating remains reliant on natural gas, especially in cold climates that encompass much of North America, Europe, and Russia. US LNG exports should continue to grow quickly as there is significant price arbitrage and emerging demand sources like China and India. Finally, data center buildout in the US requires a lot of stable power sources. Nuclear buildout is slow, coal is dirty, renewables lack the energy density and reliability, leaving natural gas, which can be built fast and reliably.

Natural gas is the engine that keeps our houses warm and businesses running. It is not going away anytime soon, nor should it, even if you want to reduce emissions. It has shown success in bridging the US off of coal, and the US is in a prime spot to take advantage economically of other nations doing the same. US natural gas prices have been boring for years, but given the extensive enough demand for US exports, interesting investment opportunities can arise. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView