What's Up With: Coal

Are coal's days numbered?

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

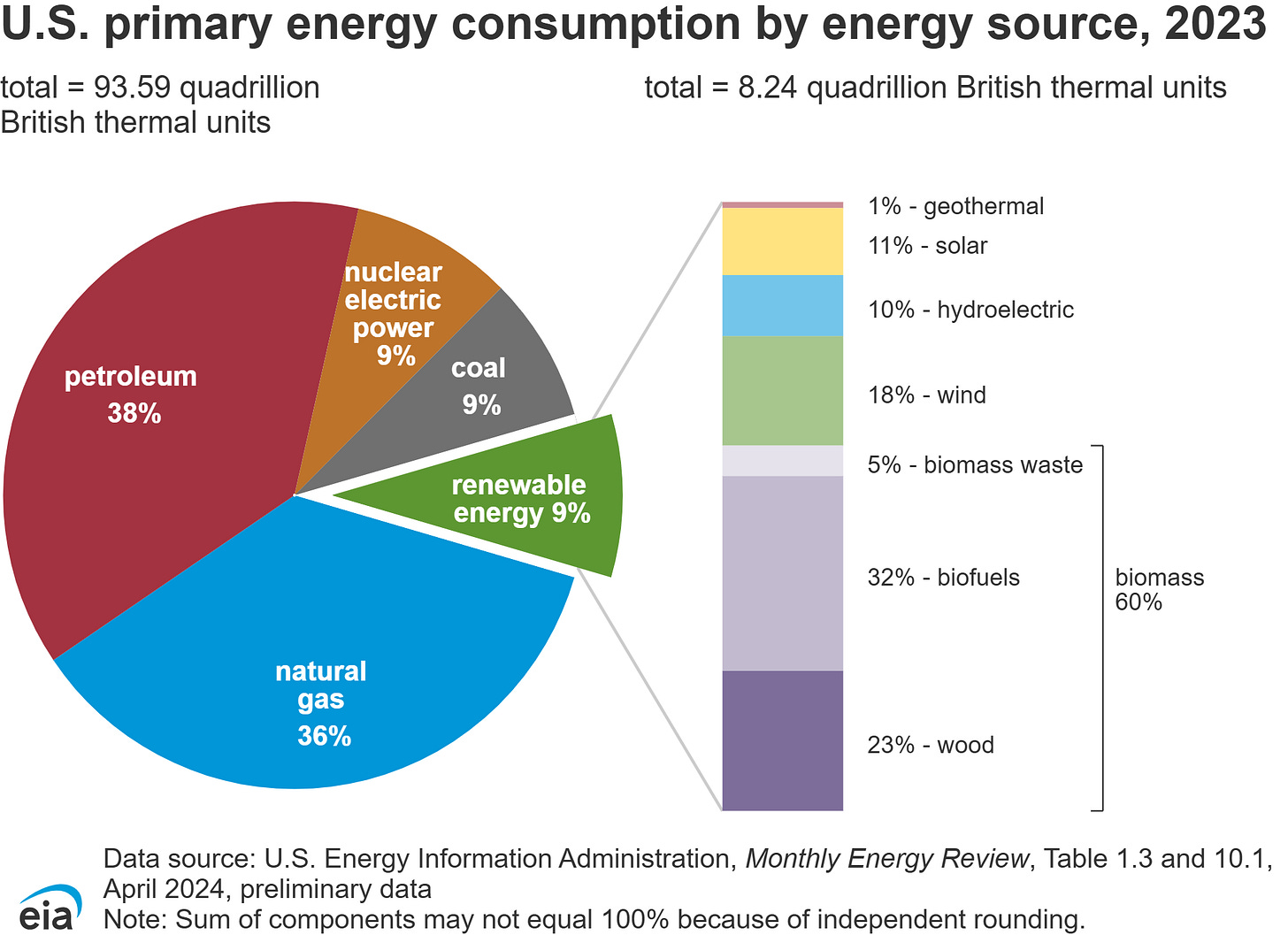

Energy consumption encompasses more than just electricity. While renewables accounted for 21% of electricity in 2023, they only account for 9% of total energy consumption. This also includes transportation, heating, and industrial use. While it would be nice to have a perfectly sustainable grid, the reality is different. In this series, I will highlight the roles of various energy sources and their outlook. For the year 2023, fossil fuels accounted for 82%, nuclear 9%, biomass 5.4%, and renewables 3.6%.

This is a series I’m going to do where I will research and update my outlook on each energy industry: renewables, batteries, nuclear, and fossil fuels. This week is about coal.

Coal

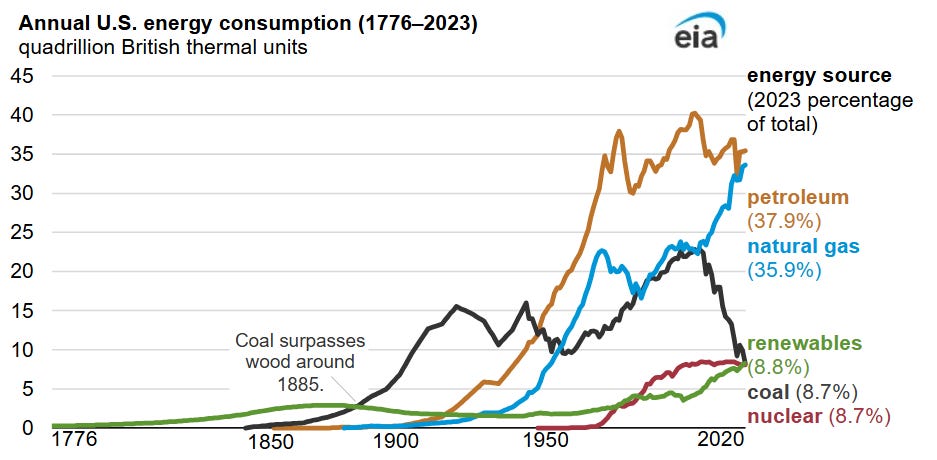

As the saying goes, “out with the old, in with the new.” While the new is hotly debated between renewables and nuclear, the old is definitely coal. Coal was the dominant energy source in the US from 1885 to the late 1940s, when other fossil fuels took over. Further, the average age of coal plants is over 40 years old, and we don’t build them anymore. As I discussed last week in Natural Gas, since the shale revolution, natural gas has aggressively displaced coal as a primary energy input in the United States in recent years.

The primary reason for this, like most things, is cost. While some argue that the Clean Power Plan regulations in 2014 under Obama led to the demise of coal, the reality is that coal consumption peaked in 2007 and has been steadily declining since then. Approximately 92% of coal consumption is used for electricity, and the availability of cheap natural gas for electricity offers a direct replacement. Regulations on coal don’t help, but this decline was a story already written.

Nearly all coal comes from domestic production. Other than electricity production, 8% of coal consumption goes towards industrial applications like heating, metallurgy, cement, and carbon products. There are different types of coal for this wide array of use cases. In order of their carbon content, there are anthracite, bituminous, subbituminous, and lignite.

Graphite is over 98% carbon and used for tires and batteries, compared to 86-97% for anthracite. Anthracite is mined primarily in Pennsylvania, accounts for only 1% of domestic production, and is used in the metals industry. Bituminous coal contains 45–86% carbon, mined primarily in West Virginia and surrounding states, accounts for 46% of US production. Bituminous coal is used for electric production, coking coal for the steel/iron industries, and industrial heat. Subbituminous coal contains 35-45% carbon and is favored for electricity production in the US for its lower sulfur content because of environmental reasons. US production is dominated by Wyoming. Lignite has the lowest energy content and the cheapest form of coal, produced primarily in Wyoming and Texas. Containing 25-35% carbon and accounting for 8% of US coal production, it is used for electricity production and synthetic gas production.

Domestic coal consumption is declining, but exports remain steady. Small compared to consumption numbers, the US exports to India, China, Japan, Europe, and Brazil. Coal is far from dead worldwide, with China and India producing and consuming the most. China is in a league of its own, like most energy sources, burning more coal than the rest of the world combined. While Europe and the US are concerned with carbon emissions, Asia is using every cheap source of energy it can. Not only does this include their domestic electric power, but also heavy industry like steel and metals, which has been outsourced to these countries in the last few decades.

Of course, the elephant in the room is environmental ramifications. Coal is the dirtiest for gaseous and particulate pollution, as well as the worst emitter of greenhouse gases. 40% of all fossil fuel emissions stem from coal, making it a prime candidate for emissions reduction. While regulations can make a change in local jurisdictions, globally, convincing China and India to use less coal has not been fruitful. Therefore, innovating and providing cheaper and cleaner options is required. Natural gas has played that role so far. With greater export capacity, the price arbitrage between cheap US gas and the rest of the world may be bridged. Further advancements in nuclear or renewable technology could help displace coal, but these are on longer time frames.

Some argue that since carbon capture technology exists, it is fine to continue burning coal. Technically, it has been shown that over 90% of emissions can be captured. However, there are significant costs associated with this. Not only that, the upfront costs of the plant retrofitting may be difficult for power plants whose margins have been eroded in the US by cheaper gas plants. Overseas, there hasn’t been much impetus to reduce emissions, so who is to convince them to add costs now? It is nice to have idealistic decarbonization goals, but the reality is that people want cheap things, so carbon capture will not work or will have to be subsidized.

Finally, steel production is difficult to decarbonize due to the use of coking coal. Not only is coal useful for its thermal energy generation, required for the high-temperature furnaces used in steelmaking, but it is also a chemical reagent used in production. Hydrogen-powered and other clean steel production advancements remain in early stages and economic sinkholes. The majority of steel is made with coal and will be for a long time.

Outlook

Coal’s days may be numbered in the US, and perhaps rightfully so. Regardless of your thoughts on climate change, the environmental impact of coal on pollution is the worst of any energy source, even without considering carbon emissions. However, the rest of the world has not gotten the memo, building coal power plants and burning record amounts. Further, the demand for coke for steel production will be one of the last areas of decarbonization, if ever. This provides a long, steady demand for coal into the future, despite its inferior environmental impacts. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView

China's position as the world's largest coal consumer really puts the global decarbonization chalenge into perspective. Companies like China Shenhua Energy are positioned to benefit from this sustained demand while the rest of the world transitions away. The steel production angle is particularly interesting since it highlights how certain industrial processes simply can't be easily decarbonized.