🔋Year Of Pain... For Real This Time

The US avoided recession in 2023 which surprised many. Are we out of the woods or could Jerome Powell's "pain" still be waiting?

Press the heart button on this article, yes you! I would greatly appreciate it :)

At the end of 2022 in Year Of Pain, I discussed the Federal Reserve’s aggressive rate hiking campaign and the increasing worries about recession. In a speech, Fed Chair Jerome Powell said there would be pain on consumers and businesses as part of their rate hiking campaign. I went on to show the time lag after previous rate hiking cycles and yield curve inversions to when recession arrives and the unemployment rate starts increasing meaningfully. I also suggested that higher interest rates make investments into the energy transition and in particular wind, solar, and natural resources more difficult.

As an investor, sometimes being contrarian to the narrative pays off and I mentioned that a recession in 2023 was not obvious and could easily be pushed out in time. This turned out to be a prudent intuition as 2023 ended with a stock market (SPX) up 24% on the year, consumer confidence steadily rising, holiday sales remaining strong, and sounds of a no/soft landing (missed/mild recession) perpetuating through the headlines. Of course, discussion of soft landing typically picks up right before we see a big recession…

“The prevailing consensus right before things went downhill in 2007, 2000 and 1990 was for a soft landing,” said Gennadiy Goldberg, a rates strategist at TD Securities. “Markets have trouble seeing exactly where the cracks are.” - NYT

My prediction about rising issues for the renewables sector showed some merit and presented itself most clearly in the offshore wind industry, which I discussed in Wind Woes. With some areas of the economy visibly struggling, how do we square away the optimism in consumer confidence and the incredible stock performances of the last year? What can we expect going into 2024 based on what we now know?

Employment is one of the vital pieces to the economy as it shows how confident companies are in the future as well as provides the wages needed for consumer purchases. Currently, the unemployment rate and continuing jobless claims are at extreme lows and have not started trending higher as one may expect after a major rate hiking cycle. Historically, it has taken an average of 30 months since 2000 and 26 months based on the data in the 70s between the onset of rate hikes and the onset of the increasing unemployment rate (the real pain starts for the economy). Based on history, unemployment would rise sometime in May to September 2024 and it is not surprising that we have not had a recession yet.

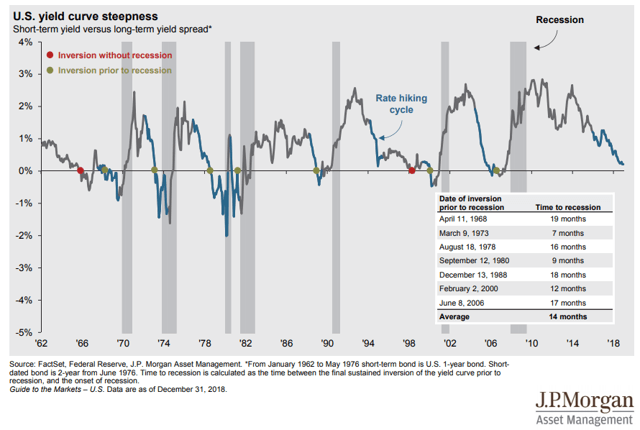

The yield curve inversion is another powerful economic indicator. I suggested last time that the stock market peaks 2-13 months after the yield curve (10year-3month) inversion based only on the last three inversions. This suggests that the stock market could be closer to its local maximum than not given we are at 13 months right now.

Based on another yield curve (10year-2year), the time to recession is between 7-19 months and on average 14 going back to 1962. This suggests that the recession would start between January 2023 and January 2024 or on average in August 2023. After this month we will be pushing the boundaries on this dataset since recession has not started yet (recessions are defined by NBER and not disclosed officially until well after a recession has hit).

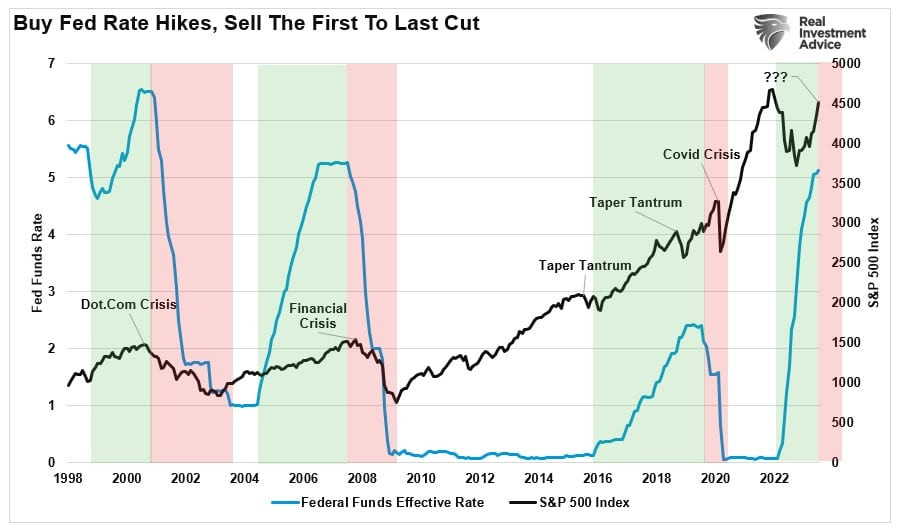

Three rate hikes are expected for 2024 which has the stock market responding optimistically. To many, a return to a lower cost of capital will spur investment and be stimulative to the economy which is ultimately true. Historically this is negative for markets though. As you can see below, the stock market usually goes down while the Federal Reserve is cutting interest rates seen in red. Interest rates act in a lag and the tightening takes time to be seen just as the cutting. It is naive to expect rate cuts in 2024 to be bullish. Typically there is some negative event that causes the Fed to lower interest rates which overides any optimism about lower rates.

Just because we skirted recession in 2023 doesn't automatically mean that we have achieved a no-landing or soft-landing. Anything is possible, but history and probability suggest that 2024 may look a lot different than 2023 with poor stock performance at some point. Recession usually means an increasing unemployment rate, lower economic growth (GDP), corporate bankruptcies, low consumer spending, lower stock prices, and many times lower consumer prices (deflation).

What could cause recession given everything seems to be chugging along fine right now? In the past, the failure of corporate earnings to match valuations, banking instability, and an oil crisis are a few examples of major catalysts associated with recessions. Each school of economic theory has different explanations for the true origins of recession which is too much to cover here. Potential catalysts that could cause government response include earnings drop and mass layoffs, bank instability (BTFP ending in March), sovereign debt instability, commercial real estate issues, energy crisis, or other black swan events.

Since the US government can print unlimited currency and manipulate interest rates, these are the methods they have and will use to respond to a recession that pops up. We have already seen sector-targeted stimulus with the Inflation Reduction Act, so it is not crazy to think that this will occur again. If an energy crisis is the cause, packages engineered towards the industry of choice for whatever political administration is in charge are reasonable to expect for example. During the pandemic, stimulus checks were sent directly to households because the economy was in an emergency state. These tactics along with printing more money to cover debts and lowering interest rates to stimulate the economy are the likely path.

The market is a better allocator of capital than the government in the long run. If the countless examples of socialism in history don’t have you convinced, the last 50 years of the United States is another example. Economic growth minus inflation (real GDP) has been on a steady downtrend since the 1970s. Over the same timeframe, the share of government allocation of capital instead of the private sector (federal debt as a percentage of GDP) has also increased. This means as the government became a larger share of the economy, the less real productivity there has been. Government response to recession is sure to increase deficits and debt even more and contribute to further devaluation of the currency. Unfortunately, instead of letting the economy recover, the government continues to step in to try to fix it by issuing more debt and programs, and I expect this time to be no different if we indeed see a recession in 2024.

I don’t see many energy transition analysts taking macroeconomics into account. There are many consequences and possible outcomes and no one can for sure predict the future, but it is good to know the possible outcomes especially since the broader economy affects all companies and sectors in some way. While the energy transition will continue to find high demand for materials required for renewables, batteries, uranium, industrial metals, and rare earths, a recession can bring temporary lulls in demand and the subsequent price. On top of this, low prices, uncertainty with the economy, bankruptcies, and the current high interest rates make investing in these sectors less likely. This will be a problem for years down the road when demand returns in earnest due to economic recovery and projects with long lead times are not available.

I don’t know for sure if 2024 is when we see a recession or if it’s punted to 2025. There’s even a chance for a no-landing, but probabilities say we get a recession and the clock is ticking based on history. A recession has broad impacts on average people, companies, and the energy transition as I mentioned. While it is hard to predict which parts of the energy sector will face the most trouble in this scenario, it will certainly be another headwind for the current energy transition expectation. On top of this, the government can be expected to act as they have before with loose monetary policy and open up the debt floodgates in time of “need”. Until next week,

-Grayson

Leave a like and let me know what you think!

If you haven’t already, follow me at TwitterX @graysonhoteling and check out my latest post on notes.

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Let someone know about The Gray Area and spread the word!