Baby Steps

Politicians care about the next generation now?

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

The Big Beautiful Bill (BBB) has many significant items, including the debt ceiling, Medicaid, tax cuts, and more. Today, I will discuss one of the smaller items that you may not have even heard about. The new bill will give babies born in the next three years $1,000 worth of S&P 500 index fund.

Historically, this would have been a phenomenal strategy to help young people invest. This money could just start retirement savings or help people with starting a business when they are eligible to take control of the account.

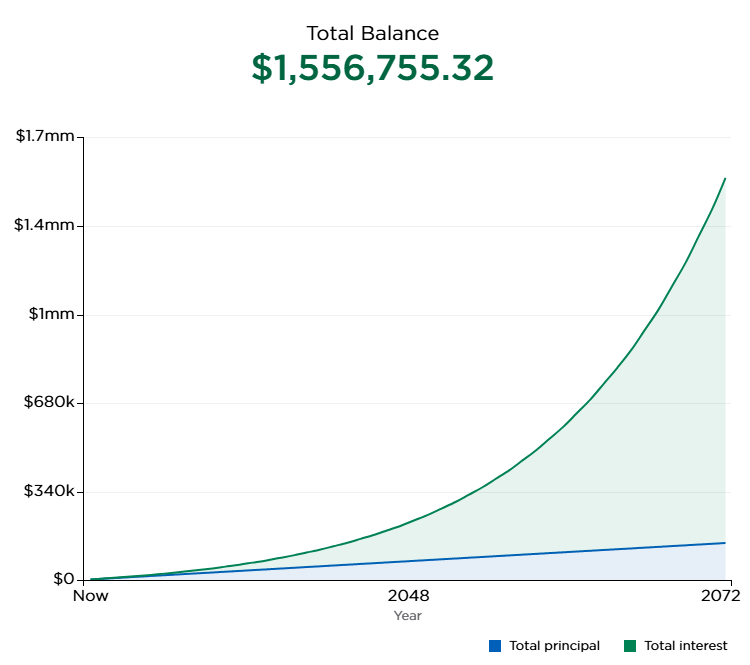

Furthermore, Einstein referred to compound interest as the 8th wonder of the world. The extra 18 years of compound interest before income-earning years could earn you an extra $3000, assuming an 8% return in the stock market. All else equal, high school graduates will have $4000 for free instead of zero. If one saved this through retirement, that would mean an additional $150,000 at age 65. This could be an extra year or two of retirement for some people.

Many criticize Social Security on this point. The return on investment for this social program is astonishingly low, but even worse, it is mandatory. If individuals were able to invest in the stock market instead of paying social security tax, the return would have been much higher historically. You would be much better off in retirement without the government’s “help”.

Is this new policy evidence that they are wising up to this strategy and have the best interests of the next generation in mind? Well, if you know anything about the boomer political class, you know that isn’t the case. The BBB also applies additional social security tax deductions on those over 65, go figure. So if they don’t actually care about the youth, what’s really going on?

What’s really going on is that everyone is addicted to money flows. Financial institutions are fiending for your money, regardless of where it is invested. Money flows equal fees. At the same time, market returns are affected by money flows to a larger extent each year. Passive money flows (aka the giant mindless robot) are mainly driven by retirement contributions through employers and target date funds by financial institutions.

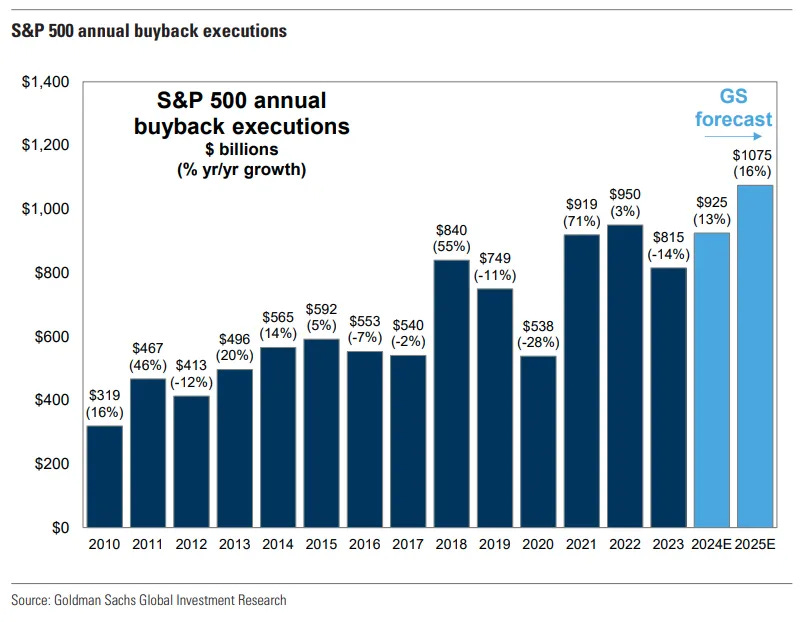

It all goes back to passive flows with the stock market. Mike Green has done the most work on this topic. I’ve written in detail about how passive capital flows into index funds like the S&P 500 distort markets and boost prices. Money flows also equal a disproportionate effect on the larger weighted stocks in the index, which causes a feedback loop with a larger ability for share buybacks.

Boomers are entering retirement. Soon, the passive flows that juiced the stock market will have to be taken out as distributions. Since the boomers are in great numbers with respect to younger generations, there are not as many young passive contributors to make up the difference. This could have disastrous consequences for stock returns at worst, or a downward pressure at best.

In summary, while it sounds like this policy is to help the next generation, it is really about juicing the stock market even further. Run out of private capital to juice the market? Let’s find ways to take it from the public treasury instead. Since boomers will stop contributing to the mindless robot, why not siphon public funds to juice the stock market even more, helping boomer retirement accounts in the process?

Call it a conspiracy if you want, but politicians, institutional investors, and large corporations know what drives stock market returns today. Passive capital combined with share buybacks has juiced it to this point, and only more flows will keep it going. Politicians tend to kick the can of reckoning down the road, and a good way to do that is to support asset prices, sometimes in odd ways.

In fairness, the total amount of money going to these newborns would likely be small relative to the total market inflows. 3.6 million babies a year times $1000 is $3.6 billion in new inflows from the government. Compare this to the ~$1 trillion in inflows in 2024 only equates to less than 1% of current flows. You could argue this is insignificant, and you may be right. However, that $1 trillion of inflows created a ~$10-15 trillion increase in market cap, meaning there is a large multiplier on these inflows.

Government programs often begin small, only to be scaled up at a later date. Public stock purchase programs like this, a sovereign wealth fund, and other programs are likely the seed to bigger conflicts of interest and federal distortion of the stock market down the line. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

LinkedIn - Grayson Hoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView