No Love

Oil and natural gas are set up for an exciting future.

If you find this article interesting, click the like button for me! I would greatly appreciate it :)

In the past, I’ve outlined where I think risks in the market are. US stocks, driven by passive investing flows (think 401k, etf inflows, foreign capital inflows, etc.), corporate share buybacks, and excessive speculation similar to 1929/1999. If stocks are expensive and warrant caution, what can you actually buy for value?

A quick search will tell you that the sectors representing the smallest share of the S&P 500 are materials, utilities, and real estate. I’ve been suggesting how attractive materials are for a while, due to debasement, mean reversion, strategic importance, and technological trends. Recently, these companies have done extremely well, which could indicate corrections even if in longer uptrends.

While representing a small share of the index, the real estate price to income ratio is abhorrently high, meaning it is expensive. This is not a sector I am touching for the time being until prices fall. Utilities are underloved compared to the market and may perform better relatively if big tech begins to falter.

Today’s article is not about any of them, however. The fourth least-represented sector in the S&P 500 is energy. Energy’s share of the S&P 500 has withered from 14 percent in 2011 to under 3 percent today. Oil has done practically nothing since the summer of 2022, when fears of the Russia/Ukraine war were subsiding. The largest energy sector etf, XLE, has performed well this month, up 15%. It has suffered from the same trend as oil prices since the summer of 2022, though.

Obviously, owning the top stocks has been the best strategy for the last decade. Overall, energy relative to the S&P500 (XLE/SPX) has been a terrible investment strategy since 2008, as seen below. Energy is an underloved asset and may be poised to go higher. Comparison charts aren’t the most trustworthy for technical analysis since they aren’t traded directly, but they can indicate relative sentiment and overbought/oversold conditions. From a technical perspective, though, we have seen an impulsive 5-wave from the 2021 low and an abc correction into the standard support region. The first target for a move up would be into the orange box, completing a C wave.

In a similar vein, natural gas companies are even more undervalued than oil companies. I had to put FCG/SPX in log scale just to see the price movement, as it had essentially drifted down/sideways since 2016. This represents an even greater reward/risk if the upside scenario plays out.

Oil and natural gas prices are low considering their long-term trend, priced in both US dollars and gold. You’ll also notice that these relationships tend to do well preceding a recession. Energy tends to do quite poorly during/after a recession. While not my highest conviction view, there could be a spike or run-up in oil prices on news or short squeezes preceding a looming recession. Overall, if recession, unemployment, and demand destruction ensue, I would not want to be holding oil and oil stocks in the short term. Natural gas may hold up better in this scenario due to its demand in residential electricity, liquified natural gas export demand, and data center buildout.

Fundamentals

Despite every analyst predicting the death of fossil fuels for the energy transition, oil demand remains robust, exceeding IEA estimates year after year. From a high-level long-term view, the thesis is that oil/gas are strategic resources for wars/de-globalization, with peaking production domestically, have larger than expected moats for future demand (data center, less EV hype), and are cheap relative to other assets.

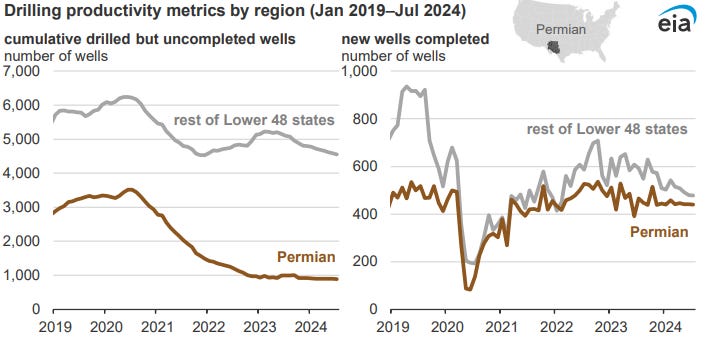

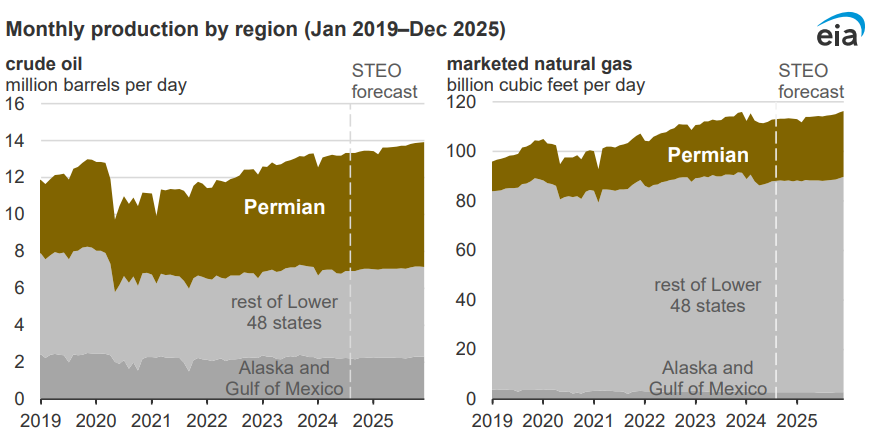

I wrote in What’s Up With Oil that the number of oil wells has been declining in the Permian basin, the largest oil/gas region of the US. This leaves the US more vulnerable and less responsive to changes in demand. It is a little confusing; an active rig drills wells, but those wells sit idle until they are completed. Completion means that they are now producing oil. The drilled but uncompleted wells are at all-time lows, while production is robust. This means that production is coming from existing drilled wells, not new drilling investment.

The newly completed wells below are misleading, knowing this. The investment into drilling the well has already been made, and the companies are merely completing it to produce oil. This is cheaper than drilling a new well from scratch and beginning production. Higher prices are the only thing that can incentivise them to use their active rigs to drill new wells.

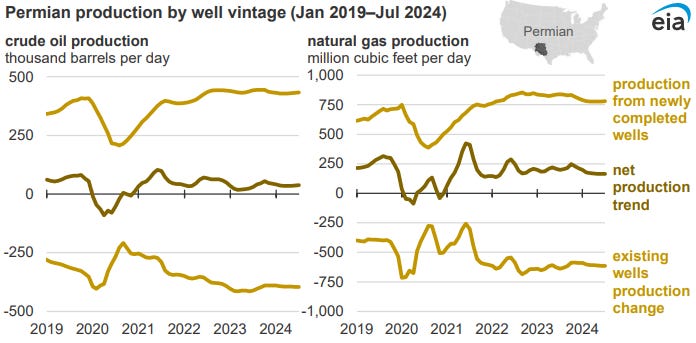

Overall production has peaked for Permian oil and gas. This isn’t doomerism for peak oil, as I think that humans will always find creative ways to produce energy, but merely noticing a trend. Is this trend driven by oil companies sensing economic weakness or by less efficient production?

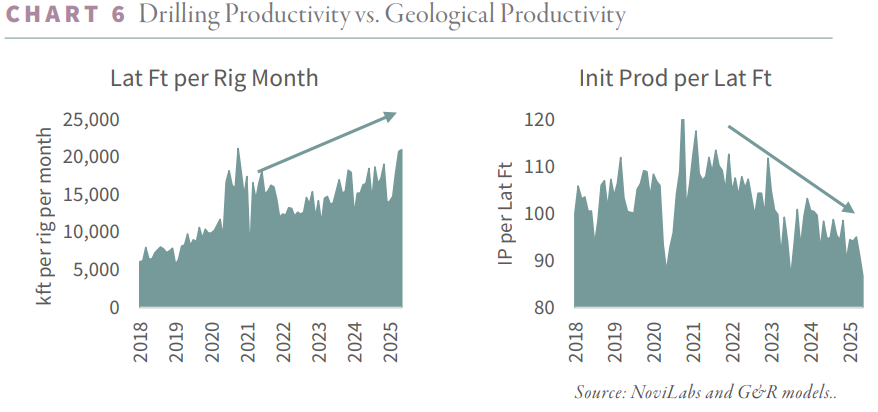

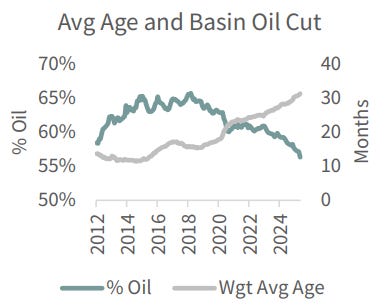

People view lower rig counts and higher production as greater efficiency. This is misleading. Oil companies are drilling existing wells more, meaning drilling further horizontally. The geological productivity of wells is actually decreasing, meaning production is losing efficiency.

One reason for this is that older Permian wells deliver a higher share of gas than oil. This means the robust nature of gas/oil liquids production is offset somewhat by the nature of drilling older wells. Further in the weeds, natural gas liquids can be refined into oil products. This is one additional factor that has helped maintain oil production.

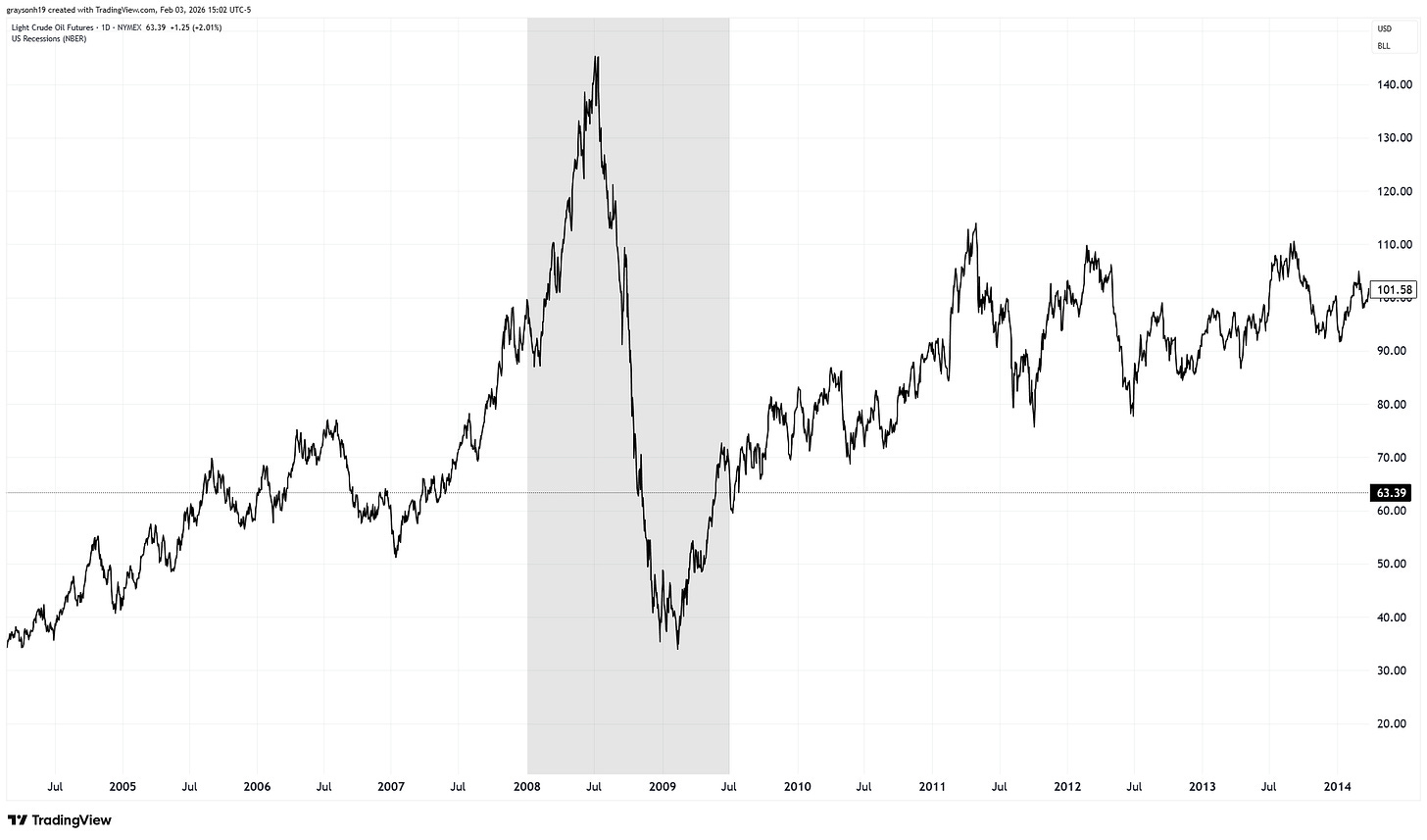

Oil prices have been consolidating since the summer of 2022, with each spike quickly suppressed. A big wedge pattern has formed technically, and any substantial break above this trend line could cause a price spike. Price spikes may not be easily absorbed by producers and potentially exacerbate into a short squeeze in the short term. Long-term, higher prices will be required for companies that have been burned by negative and lackluster oil/gas prices to activate rigs and drill more wells.

Oil/gas may do well in the short and long term and suffer in the medium term if I am 100% right. This scenario is a short-term spike higher, followed by recession bringing prices lower, then steady prices higher, similar to the 2008 period. If economic weakness takes hold sooner, we could see an immediate breakdown of the above wedge pattern and see lower prices.

The US will always find creative ways to find more oil/gas. It may be technological improvements, system-level energy changes/transitions, invading oil-rich countries (Iraq, Venezuela, Iran, etc.), higher prices, or a combination. All have been used and may be used again. These are solutions to economic problems. These economic problems are those associated with oil and gas production in the US today I’ev discussed. Layer on top technical price possibilities and the macroeconomic environment, and the energy sector is looking interesting. Until next week,

-Grayson

Socials

Twitter/X - @graysonhoteling

Archive - The Gray Area

Notes - The Gray Area

Promotions

Sign up for TradingView